OCBC

OCBC

Getting Insured on the OCBC Digital App

Getting Insured on the OCBC Digital App

Year

Year

2021 - 2023

2021 - 2023

Teammates

Teammates

Chee Ho Yoon / Experience Designer

Chee Ho Yoon / Experience Designer

Gia Phua / UI Designer

Gia Phua / UI Designer

Enrico Tanubrata / UI Designer

Enrico Tanubrata / UI Designer

My role

My role

Wireframing, Prototyping, User Journey Mapping, User Research, UX Writing

Wireframing, Prototyping, User Journey Mapping, User Research, UX Writing

Industry

Industry

Banking & Finance

Banking & Finance

Introduction

Introduction

Navigating the world of insurance is often frustrating and confusing. On this project at OCBC, we aimed to empower customers to make decisions on their insurance policies independently. This meant providing customers with relevant information in a user-friendly format and removing confusing jargon that might induce drop-offs.

Navigating the world of insurance is often frustrating and confusing. On this project at OCBC, we aimed to empower customers to make decisions on their insurance policies independently. This meant providing customers with relevant information in a user-friendly format and removing confusing jargon that might induce drop-offs.

Personas

Personas

In our research, we identified 2 personas to design for: Cautious and Impatient customers.

While both personas exhibit different behaviours, and therefore have different needs, they are similar in that they are motivated to explore and purchase insurance without the help of an insurance agent, despite the potential complexity of the task.

In our research, we identified 2 personas to design for: Cautious and Impatient customers.

While both personas exhibit different behaviours, and therefore have different needs, they are similar in that they are motivated to explore and purchase insurance without the help of an insurance agent, despite the potential complexity of the task.

Impatient customers

Impatient customers

Moderately to very savvy

Have an idea of the policy and features they want

Expect information to be provided quickly and conveniently

Impatient customers are independent, moderately to very savvy, and have an idea of the policy and features they want. They skim information and expect information to be provided quickly and conveniently.

Independent

Cautious customers

Cautious customers

Non-savvy

Require clear and detailed information on features, pricing, and how the policy works

Cautious customers are not very savvy but want to exercise independence. They require clear and detailed information on features, pricing, and how the policy works.

Want to exercise independence.

Savvy

Independent

Impatient

Cautious

We also identified a third persona: Hesitant customers. Hesitant customers require in-person interactions to be converted into customers and were not the target audience of these products.

Customer Journey

01

Awareness

Customer becomes aware of their need for insurance.

02

Discovery

Customer learns about OCBC's various insurance policies.

03

Consideration

Customer evaluates their options and selects a policy.

04

Purchase

Customer purchases the policy through an OCBC sales channel.

05

Usage

Customer's policy is in-force.

06

End of Policy

Customer's policy matures or they make a successful claim.

During my time at OCBC, the bank's focus was on the first 4 phases of the customer journey: Awareness, Discovery, Consideration, and Purchase.

Customer Journey

01

Awareness

Customer becomes aware of their need for insurance.

02

Discovery

Customer learns about OCBC's various insurance policies.

03

Consideration

Customer evaluates their options and selects a policy.

04

Purchase

Customer purchases the policy through an OCBC sales channel.

05

Usage

Customer's policy is in-force.

06

End of Policy

Customer's policy matures or they make a successful claim.

Research & Insights

I was responsible for formulating the research approach, defining participant profiles, coordinating with recruiters, conducting research sessions, and synthesising findings.

Leveraging on findings from participants' stories, I explored each phase of the insurance customer journey, identifying behavioural patterns and their underlying motivations. My findings were meticulously logged in Dovetail, providing a centralised repository for team-wide reference.

In the section below, I've noted some key insights organised by different phases of the customer journey.

Awareness

Discovery

Consideration

Purchase

INSIGHTS

Customers were unaware that they might have been inadequately covered by their existing insurance policies.

Customers were unaware that OCBC offered insurance policies.

ACTION

We needed to make customers aware that they may be inadequately covered and that OCBC’s insurance policies could help them in a trustworthy and non-pushy manner.

Challenges

Challenges

Throughout the project, we faced several challenges. Our 3 biggest challenges were:

Throughout the project, we faced several challenges. Our 3 biggest challenges were:

Quantifying the impact of design changes

The traffic to both web and mobile insurance journeys was notably impacted by marketing initiatives. The fluctuating nature of traffic presented a challenge in directly attributing performance changes to design alterations.

In cases where we had adequate volume and data, traditional metrics such as sales and click-through rates served as reliable indicators. However, for instances where data was lacking, we turned to alternative methods such as surveys and feedback from our colleagues who directly interacted with customers.

Quantifying the impact of design changes

Finding suitable research participants

Given the reluctance to discuss or consider insurance, finding participants with recent browsing or purchasing experience was challenging.

We tackled this by formulating research profiles and communicating them with our recruiters early on, and adjusting our requirements and approach where necessary.

Finding suitable research participants

Data scarcity

Data on user behaviour across various sections of the purchase journeys was scarce. Despite this limitation, we leveraged the available data to enhance decision-making processes and eliminate potential hypotheses, enabling us to iterate more rapidly.

Furthermore, after identifying specific data gaps through our analysis, we actively collaborated with the team responsible for tracking implementation, strengthening the foundation for informed design decisions.

Data scarcity

Designs

Designs

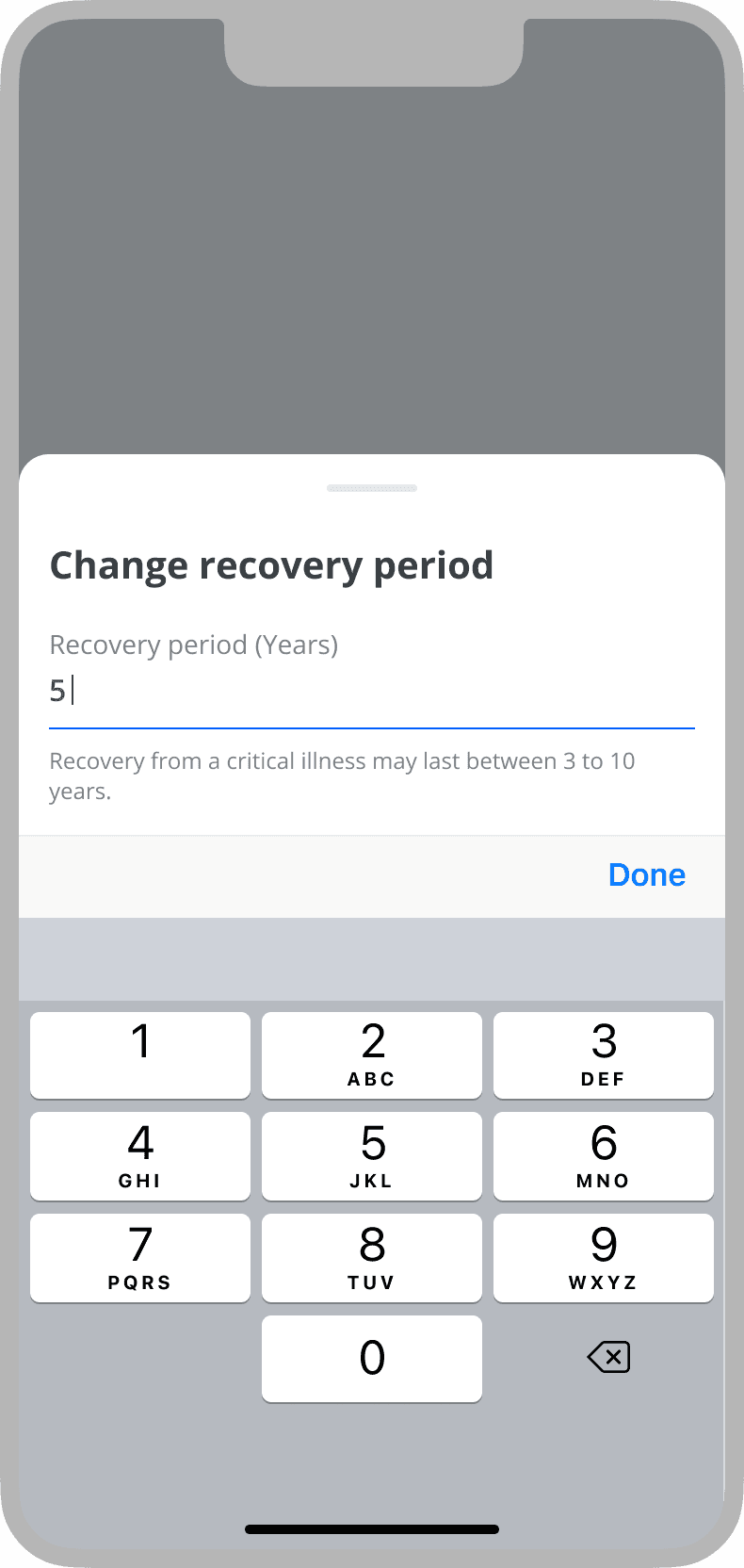

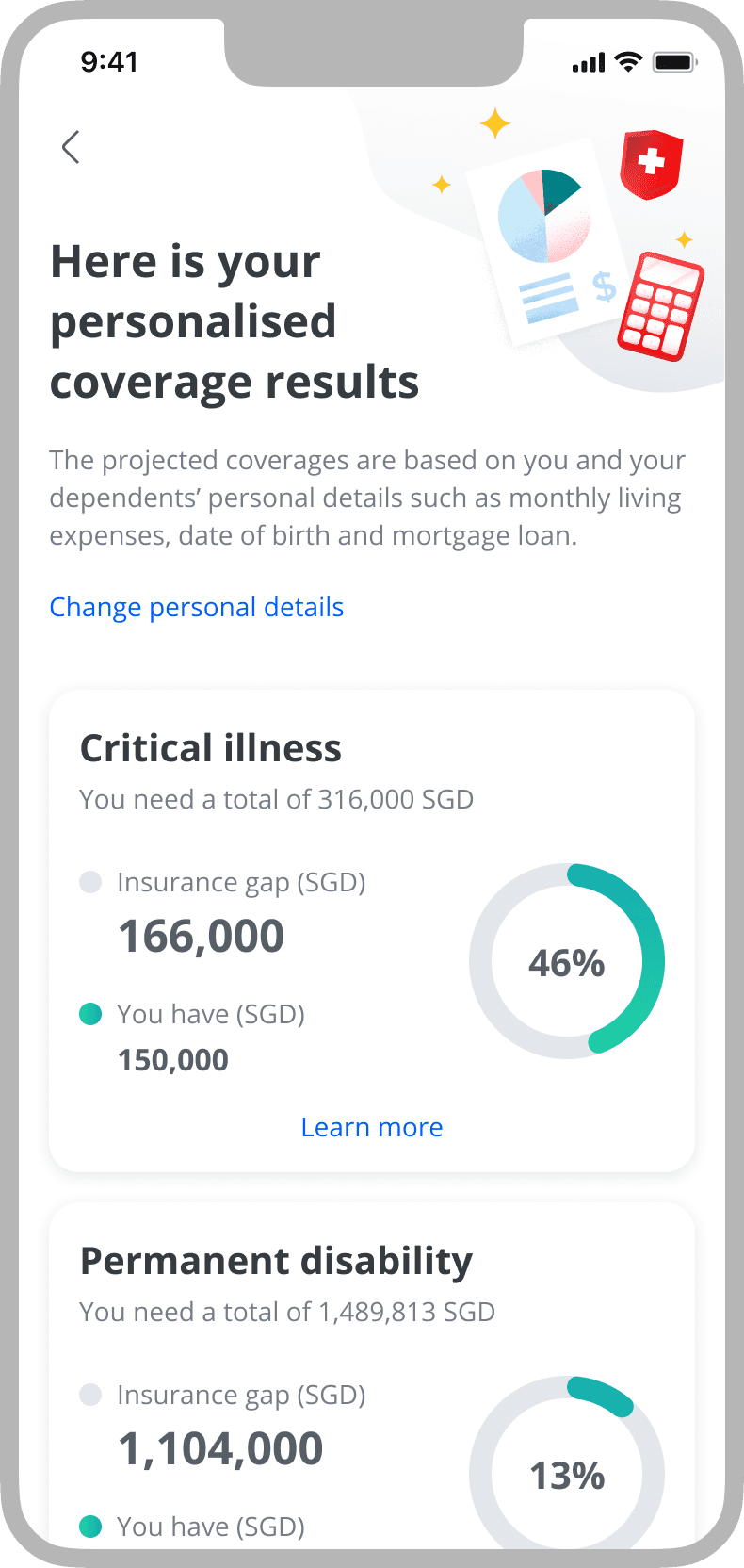

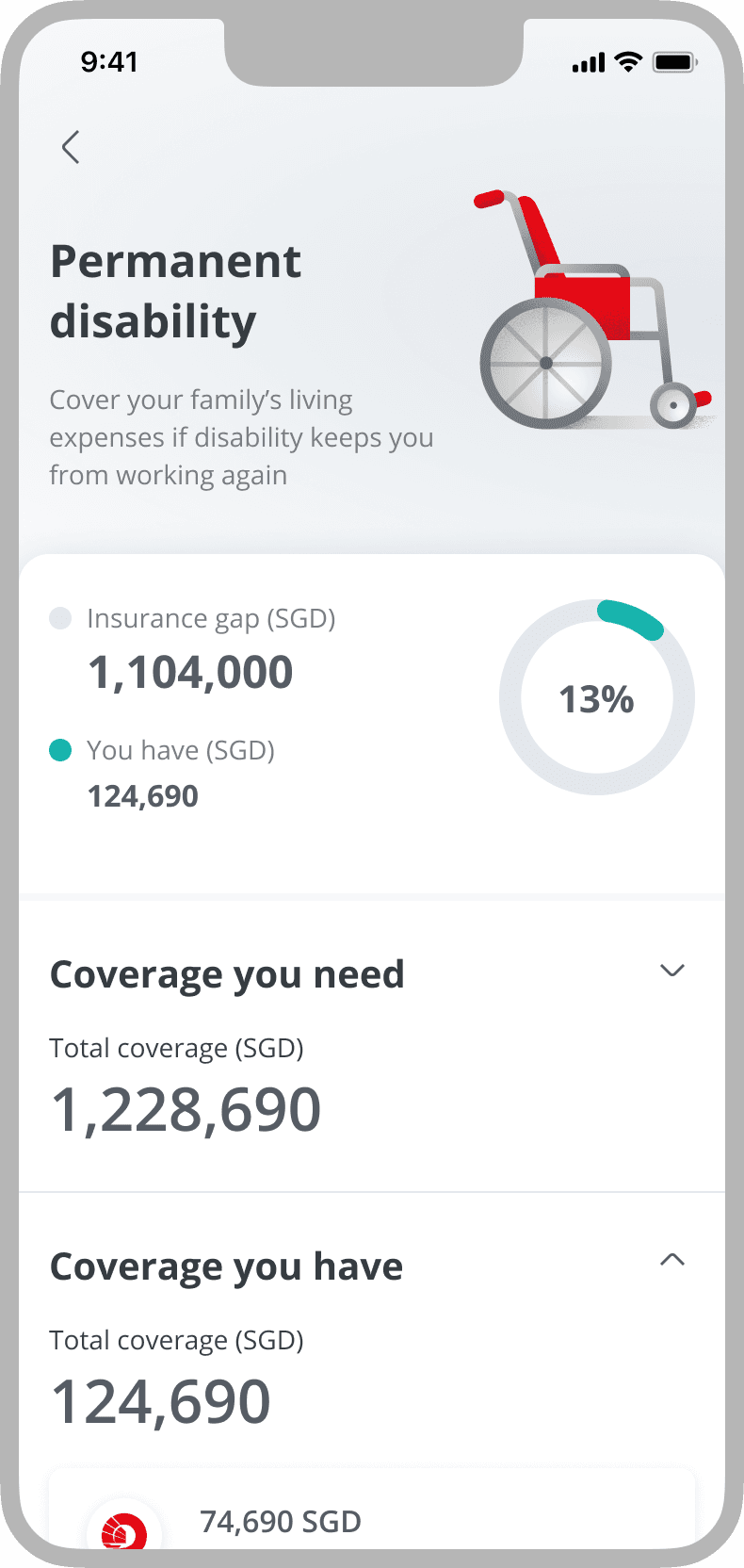

AWARENESS & DISCOVERY

Guided Journey

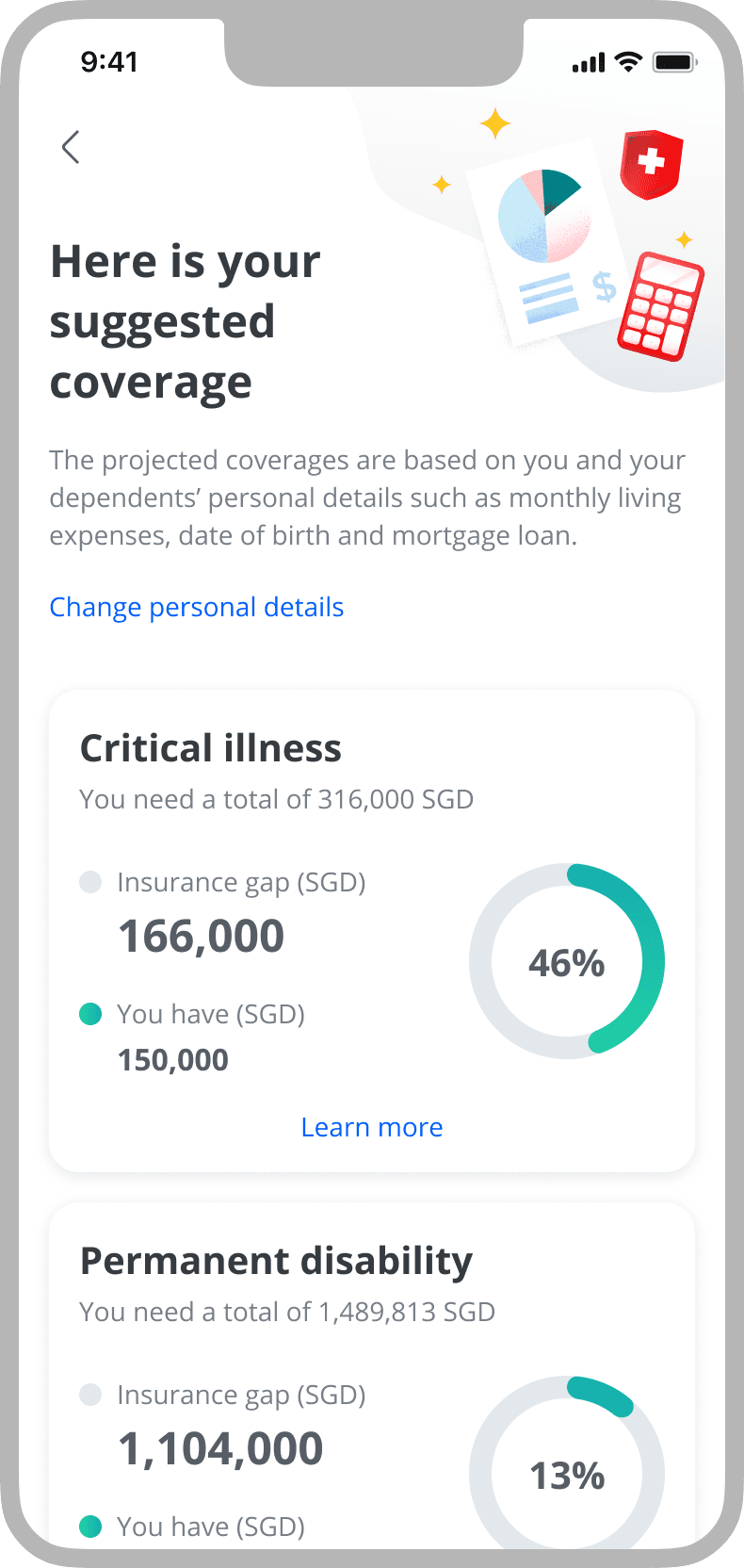

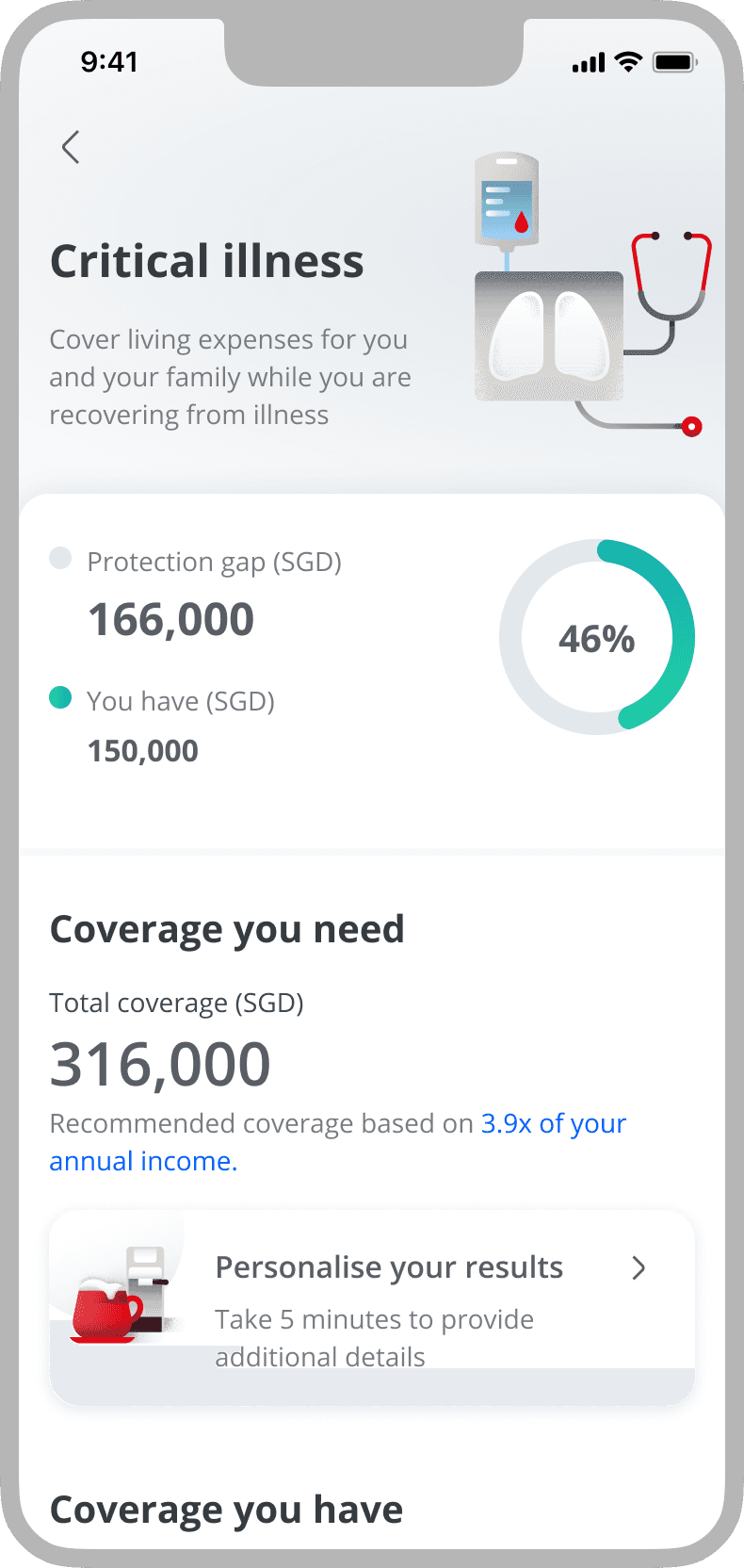

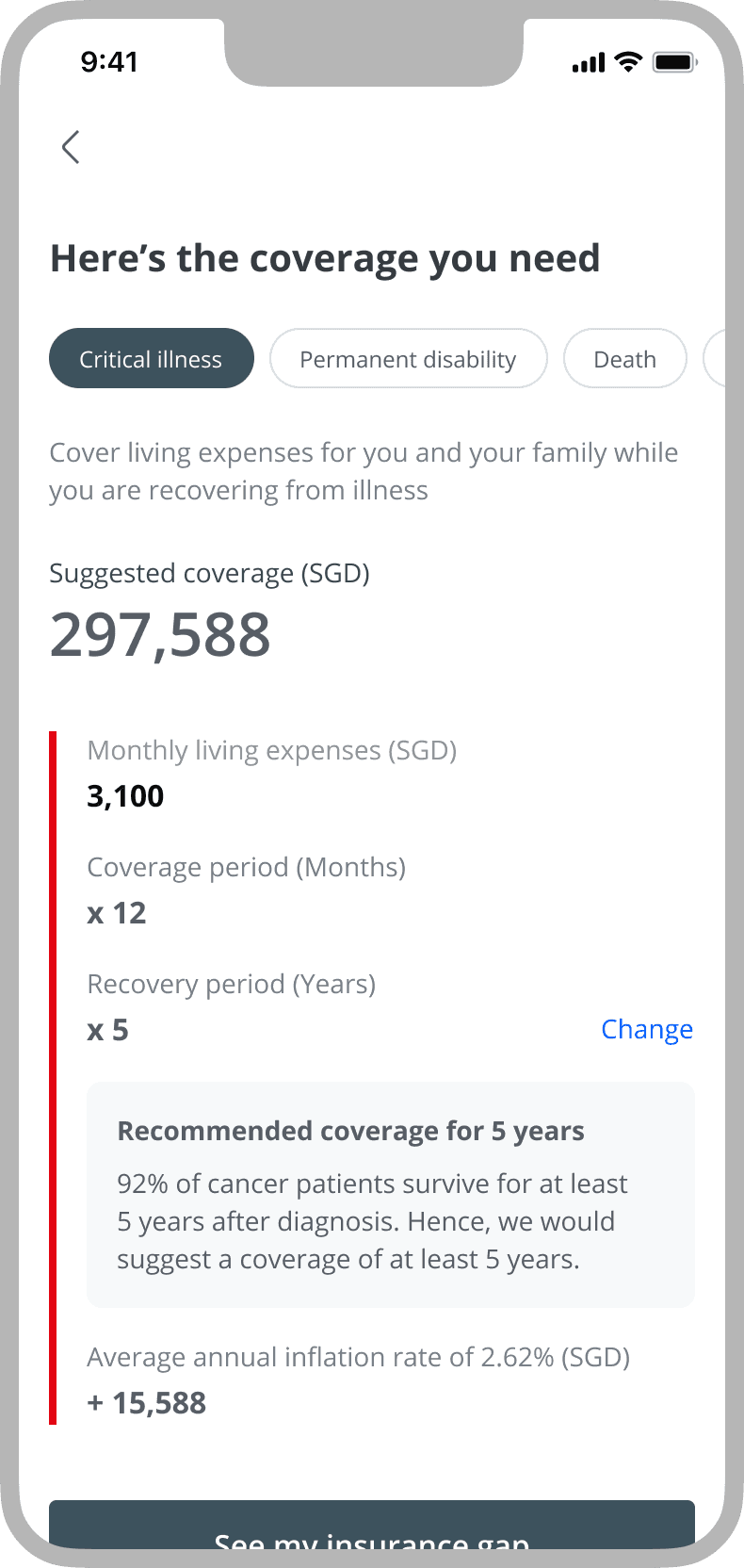

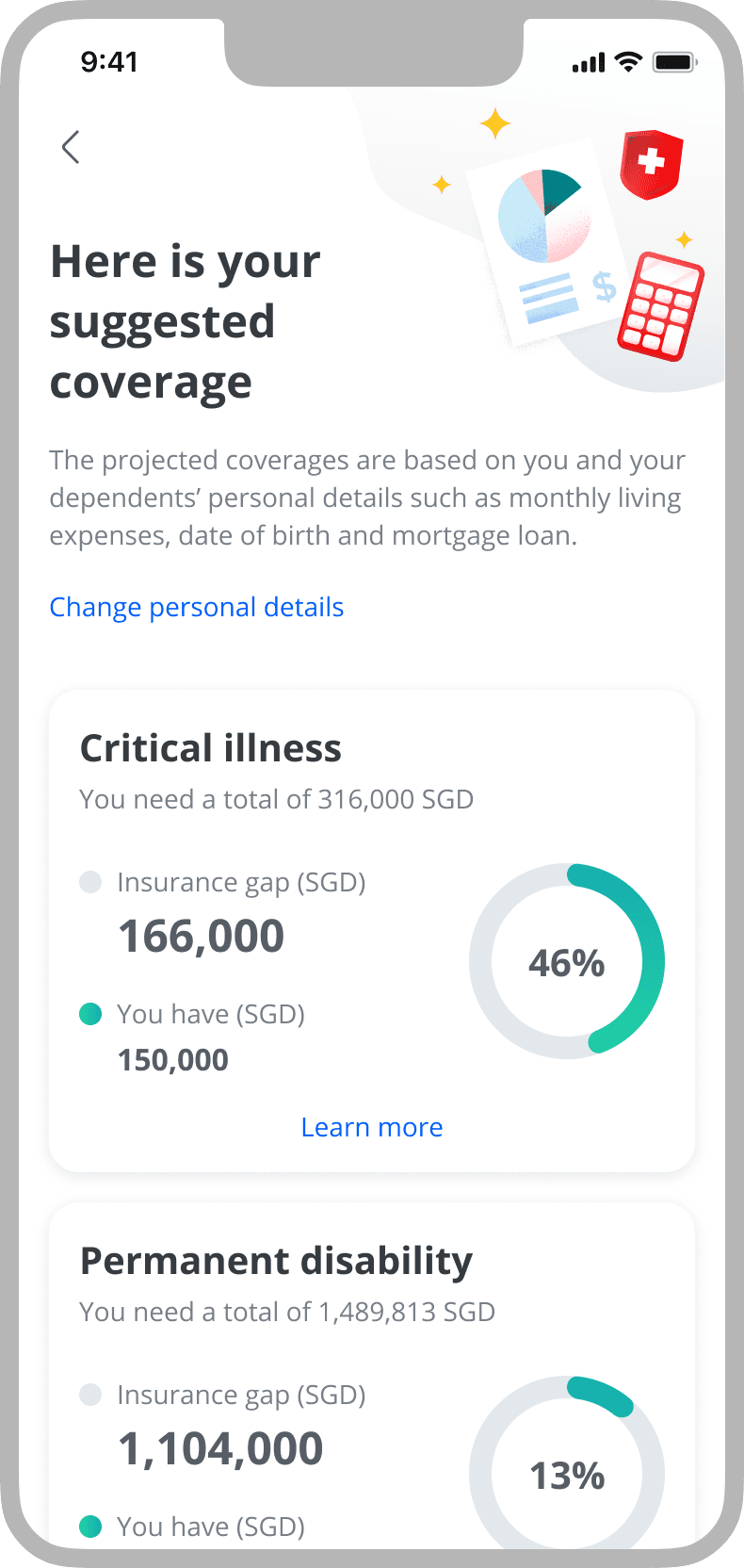

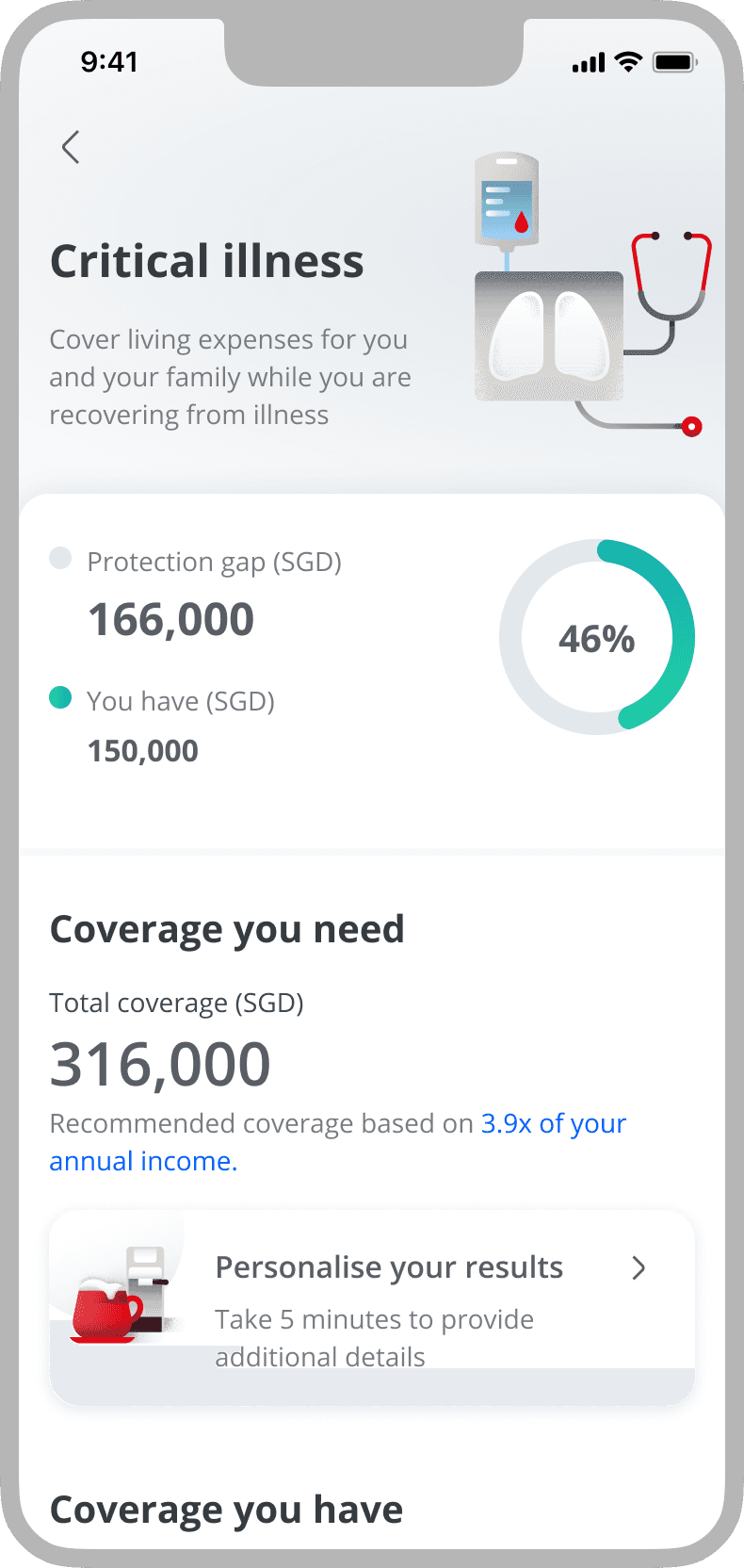

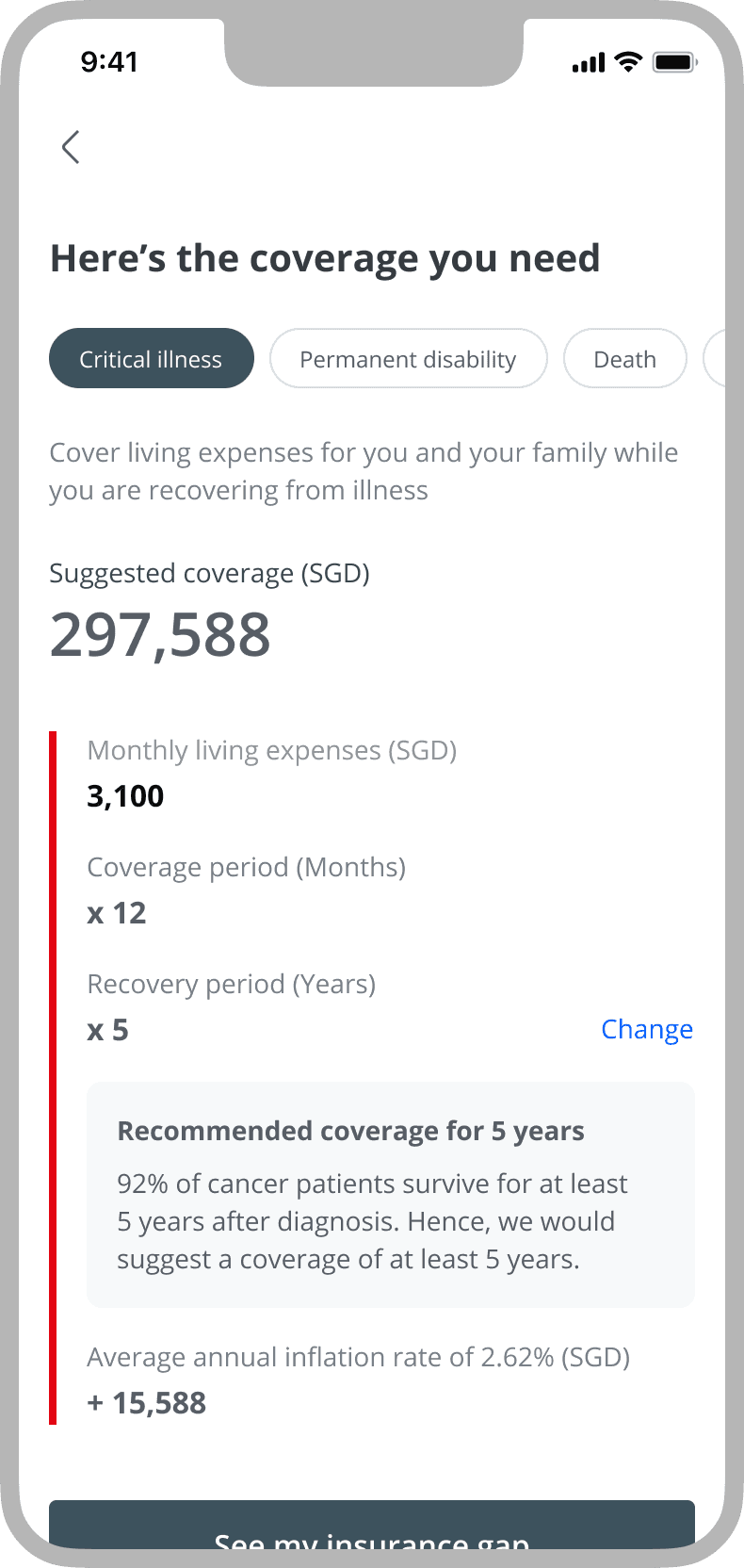

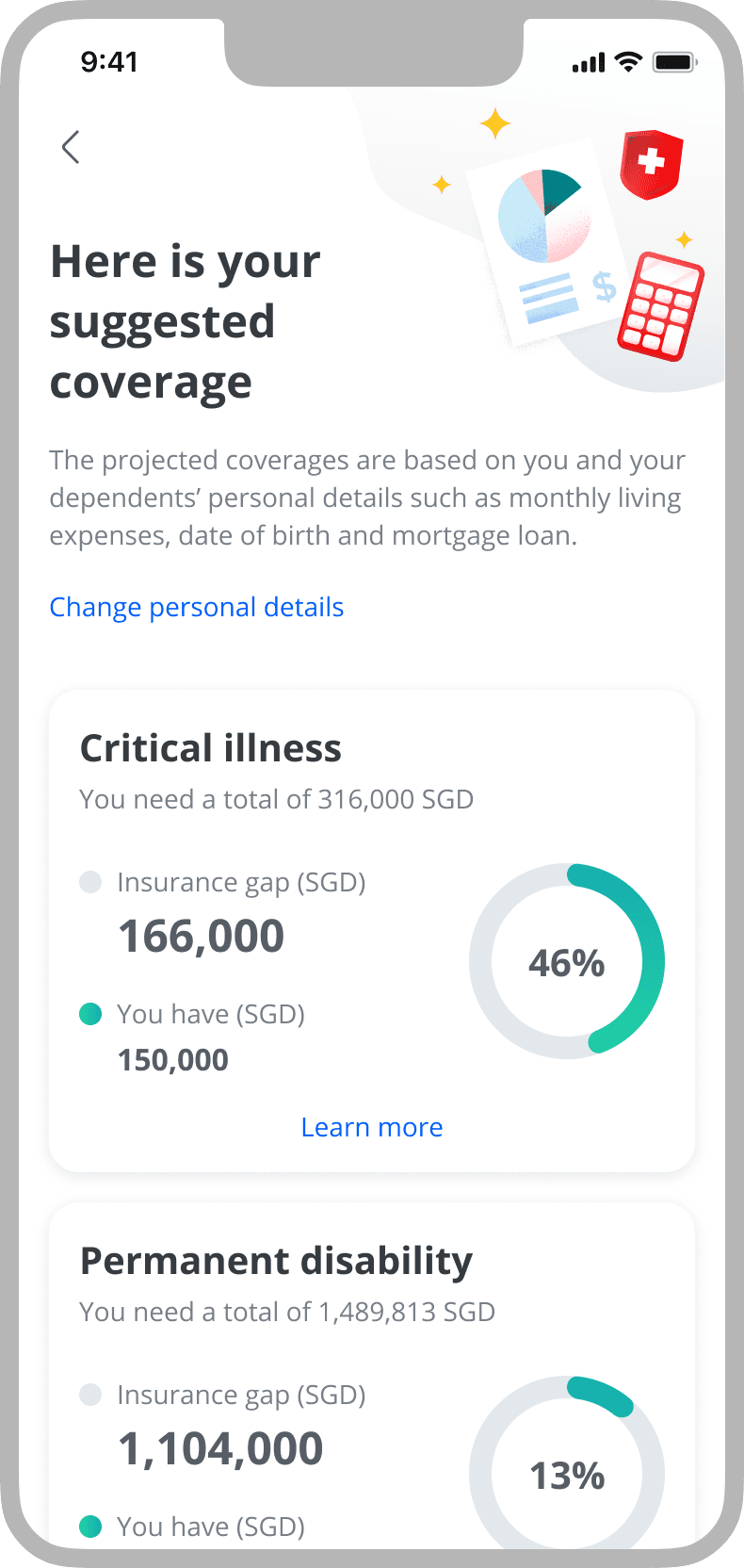

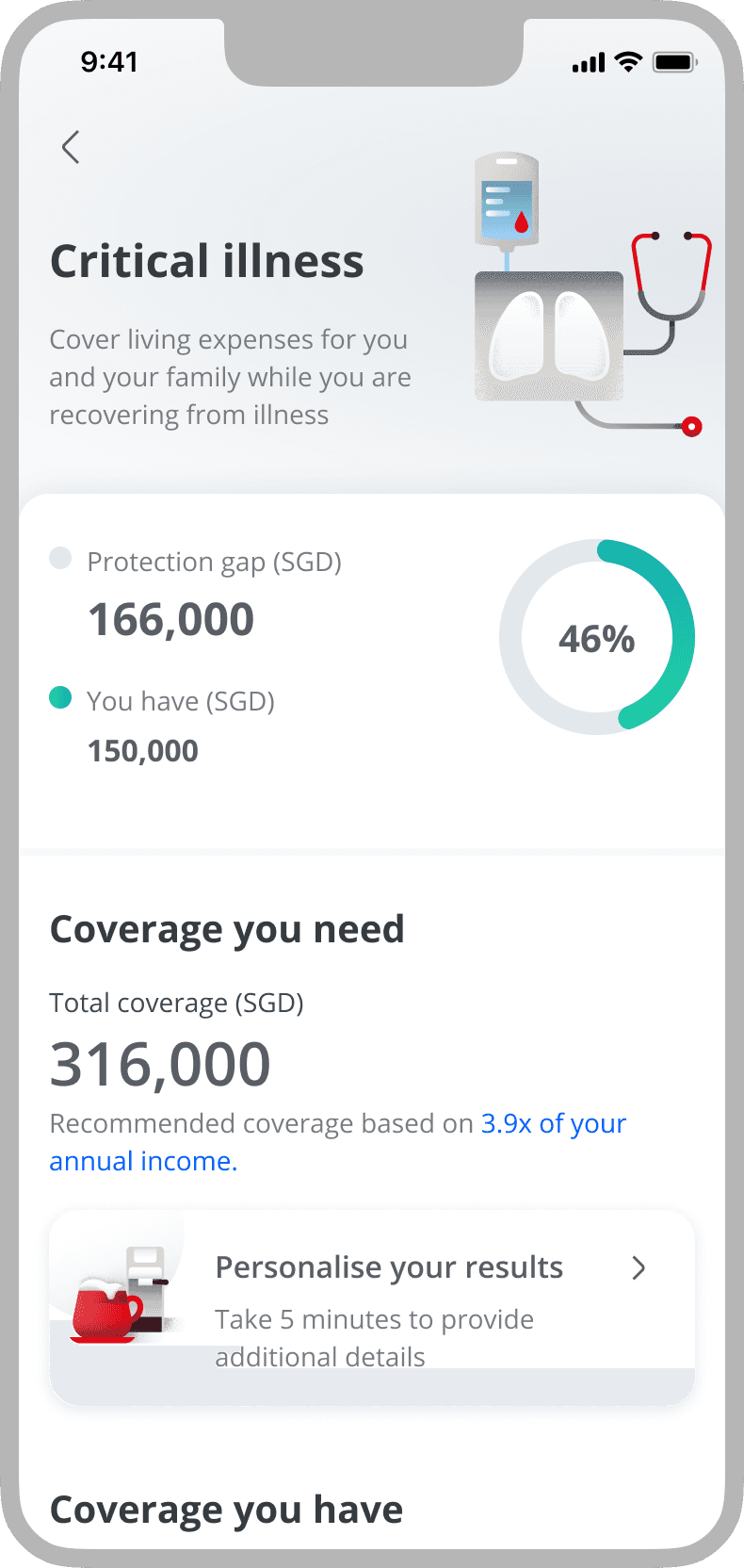

This feature in the OCBC Digital app provides customers with the convenience of viewing all their insurance policies from different providers in one place. It also empowers users to easily identify and address any gaps in their protection coverage across various aspects of insurance.

Insurance gap dashboard

Category overview

Detailed breakdown by category

AWARENESS & DISCOVERY

Guided Journey

This feature in the OCBC Digital app provides customers with the convenience of viewing all their insurance policies from different providers in one place. It also empowers users to easily identify and address any gaps in their protection coverage across various aspects of insurance.

Insurance gap dashboard

Category overview

Detailed breakdown by category

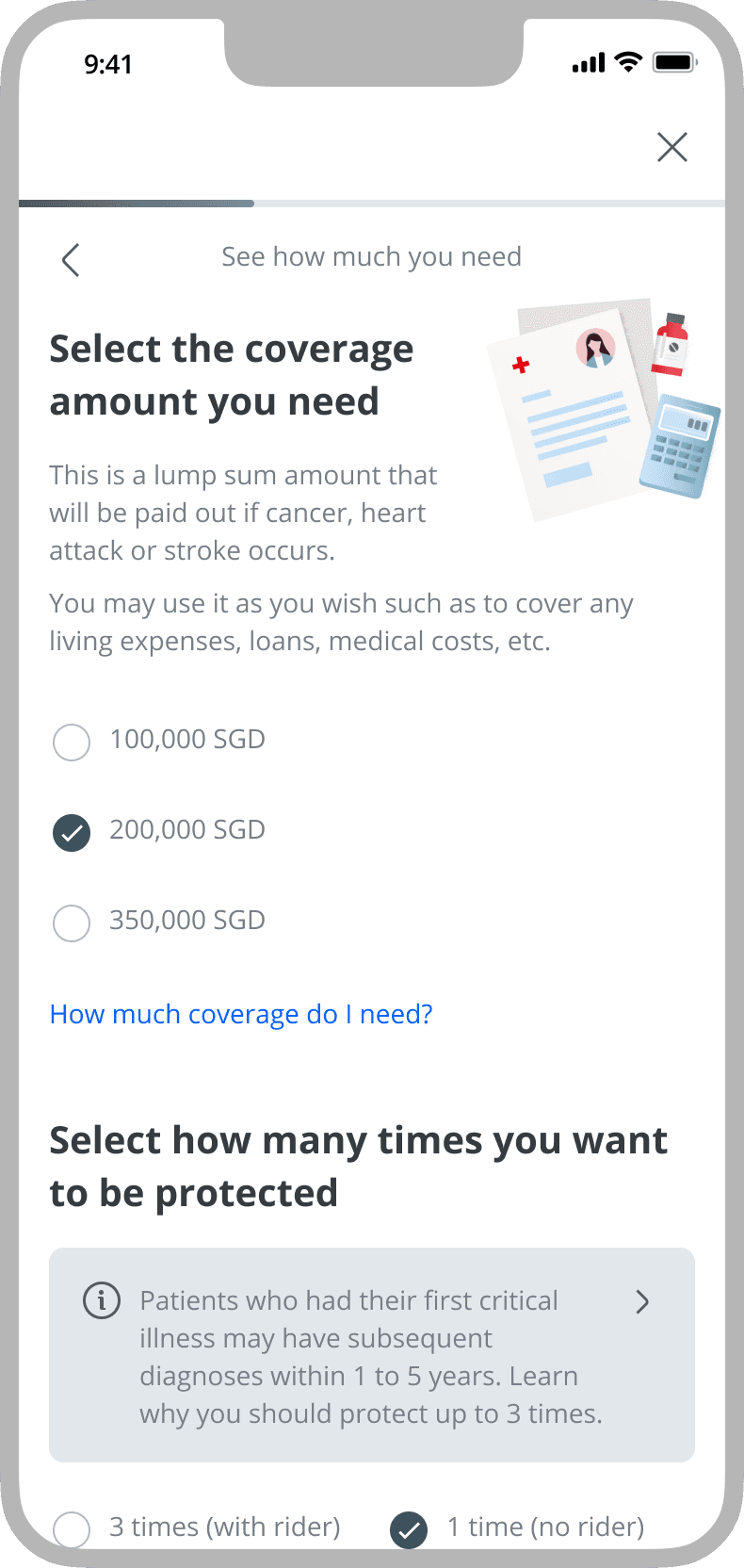

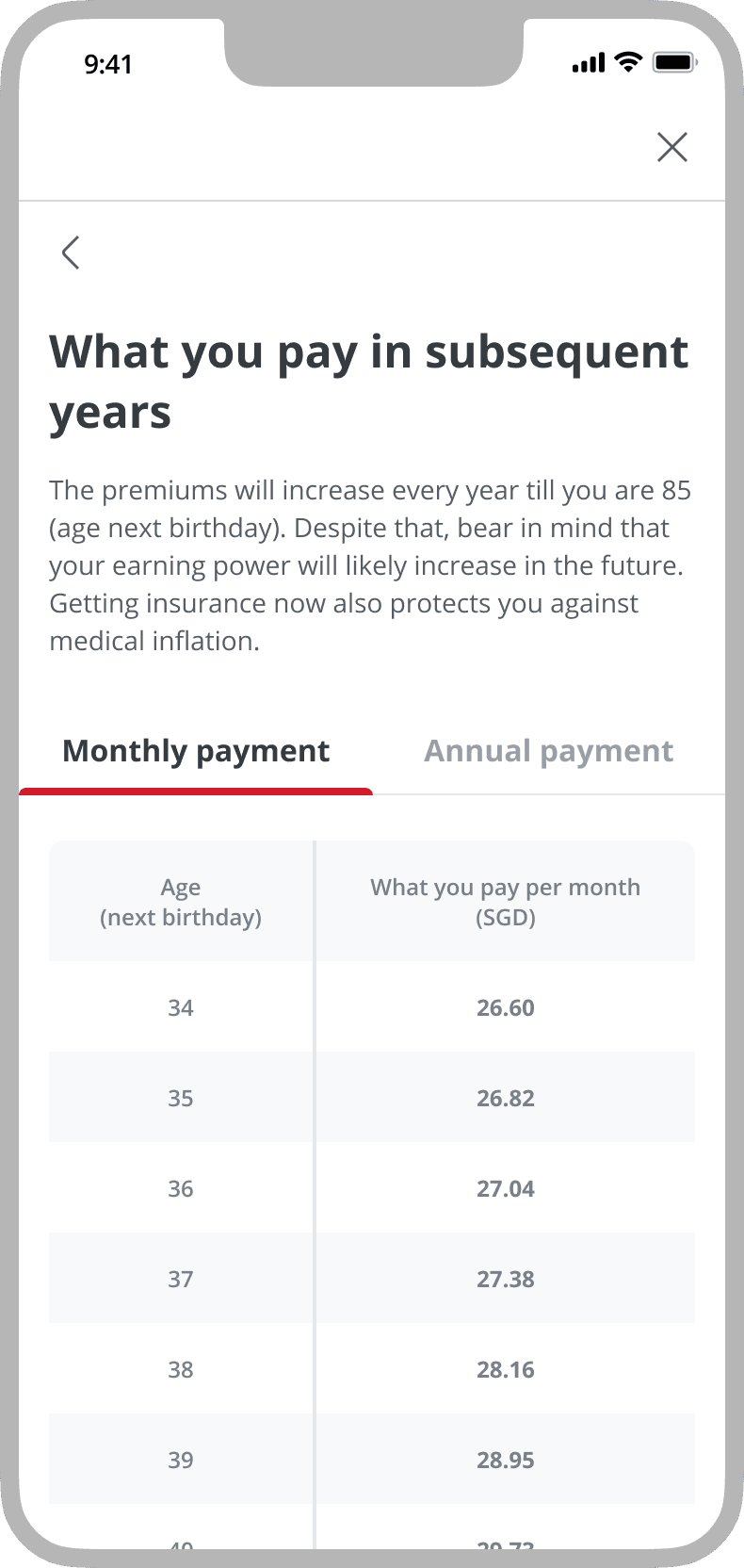

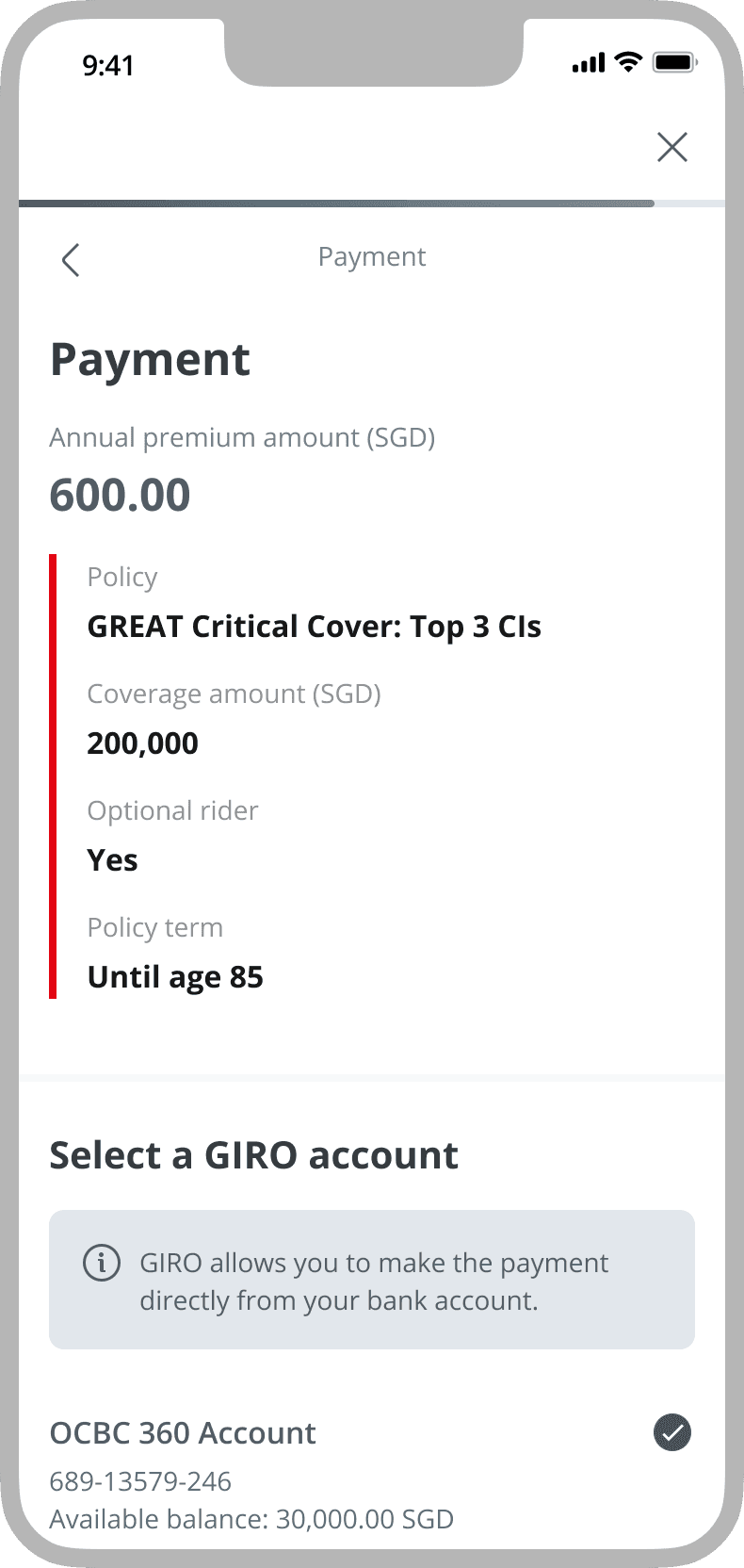

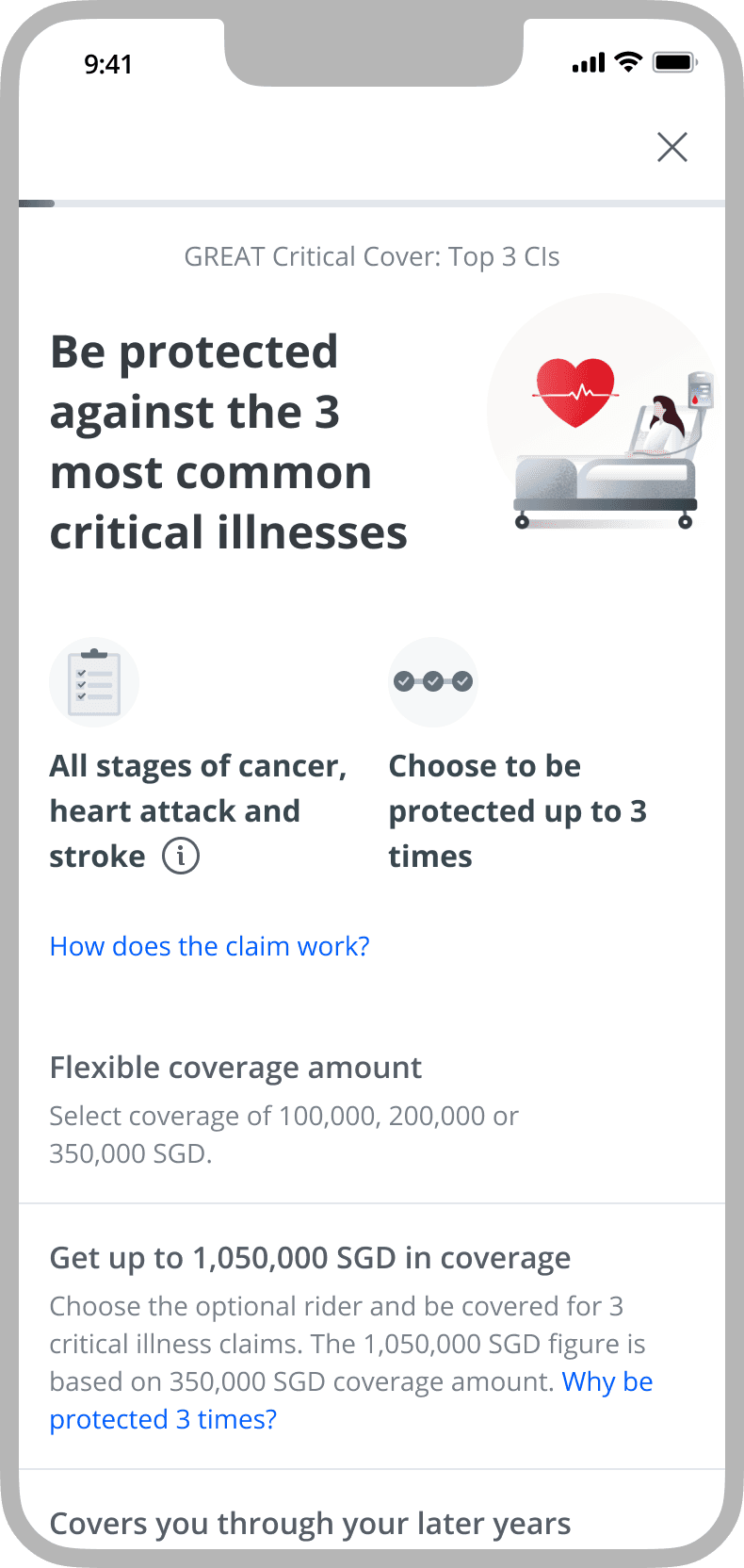

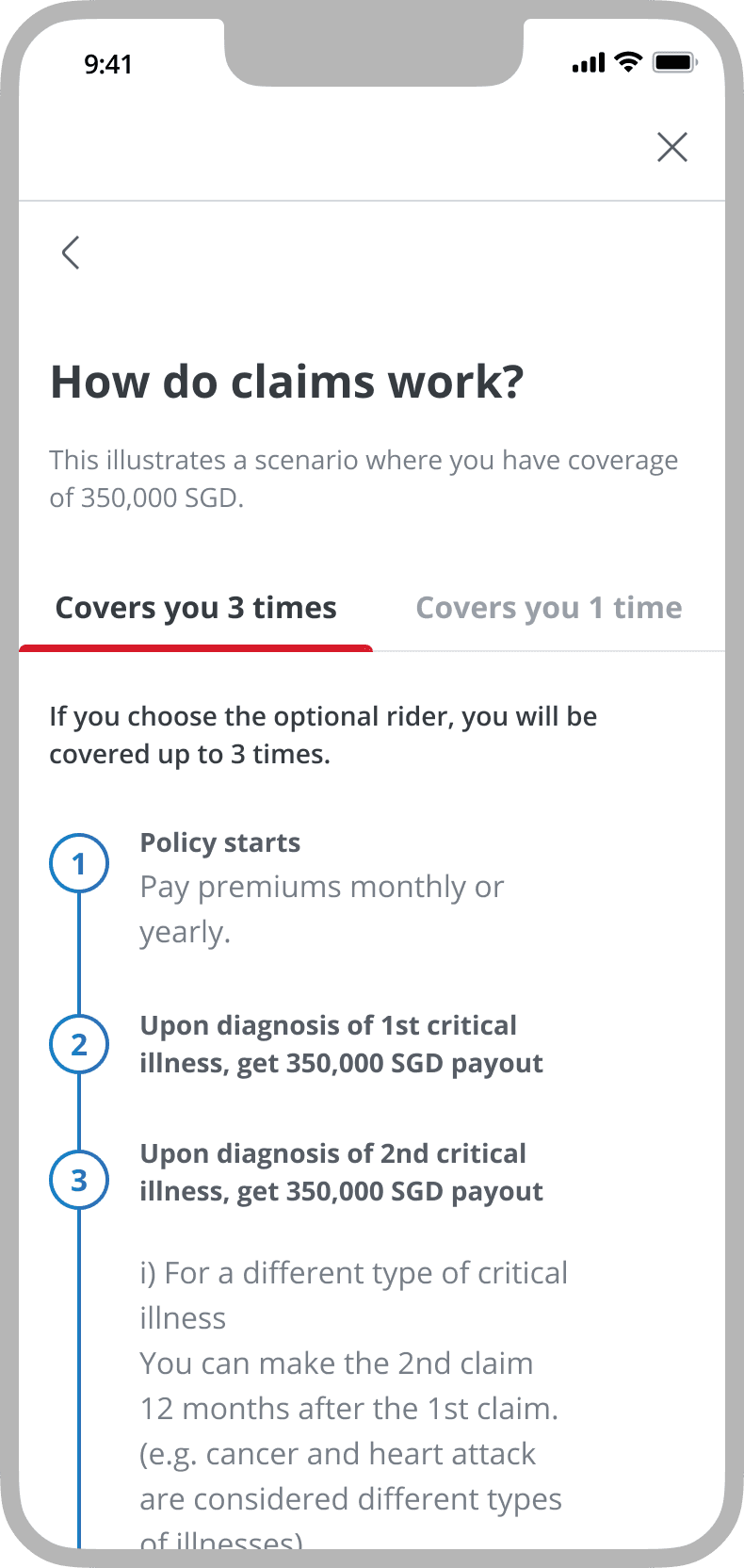

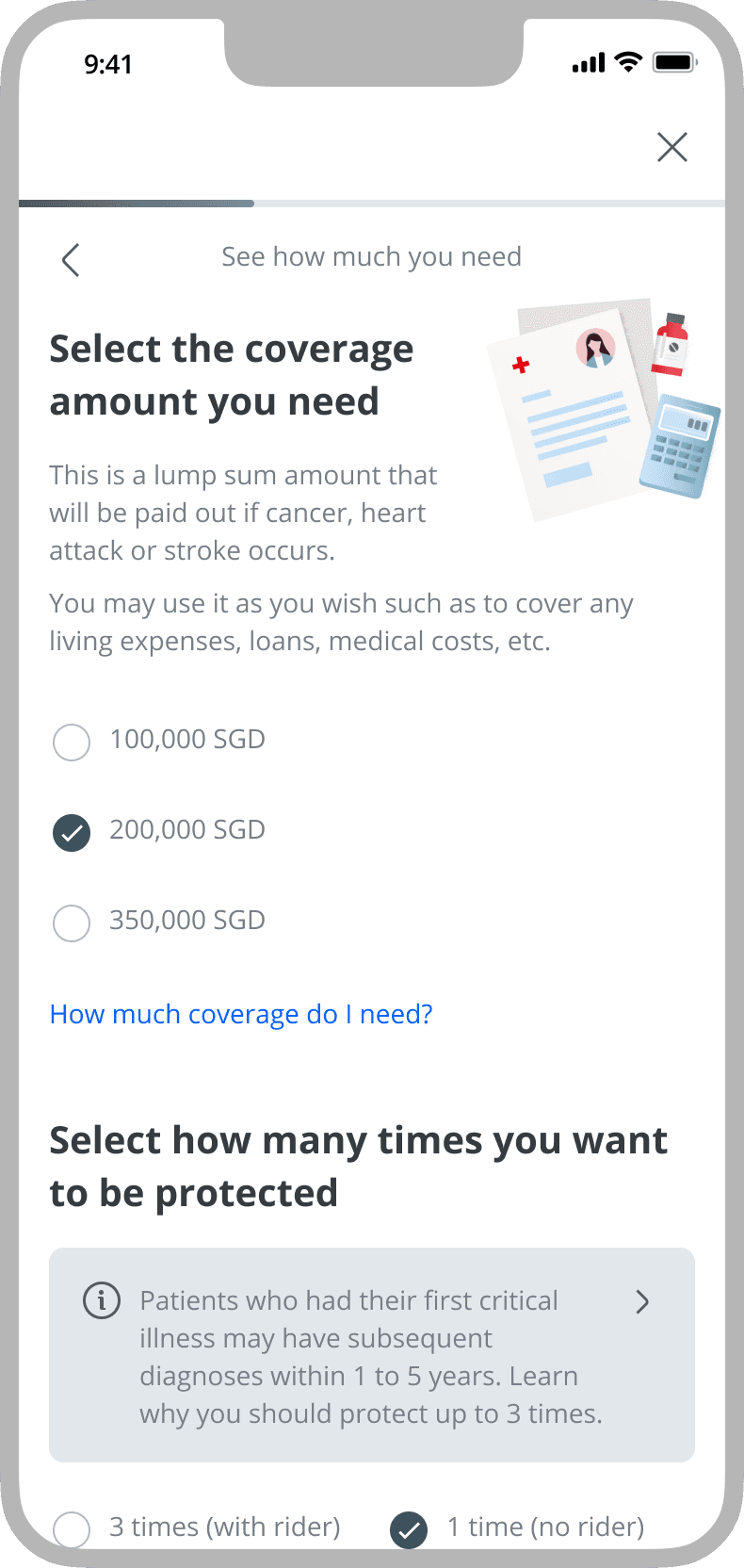

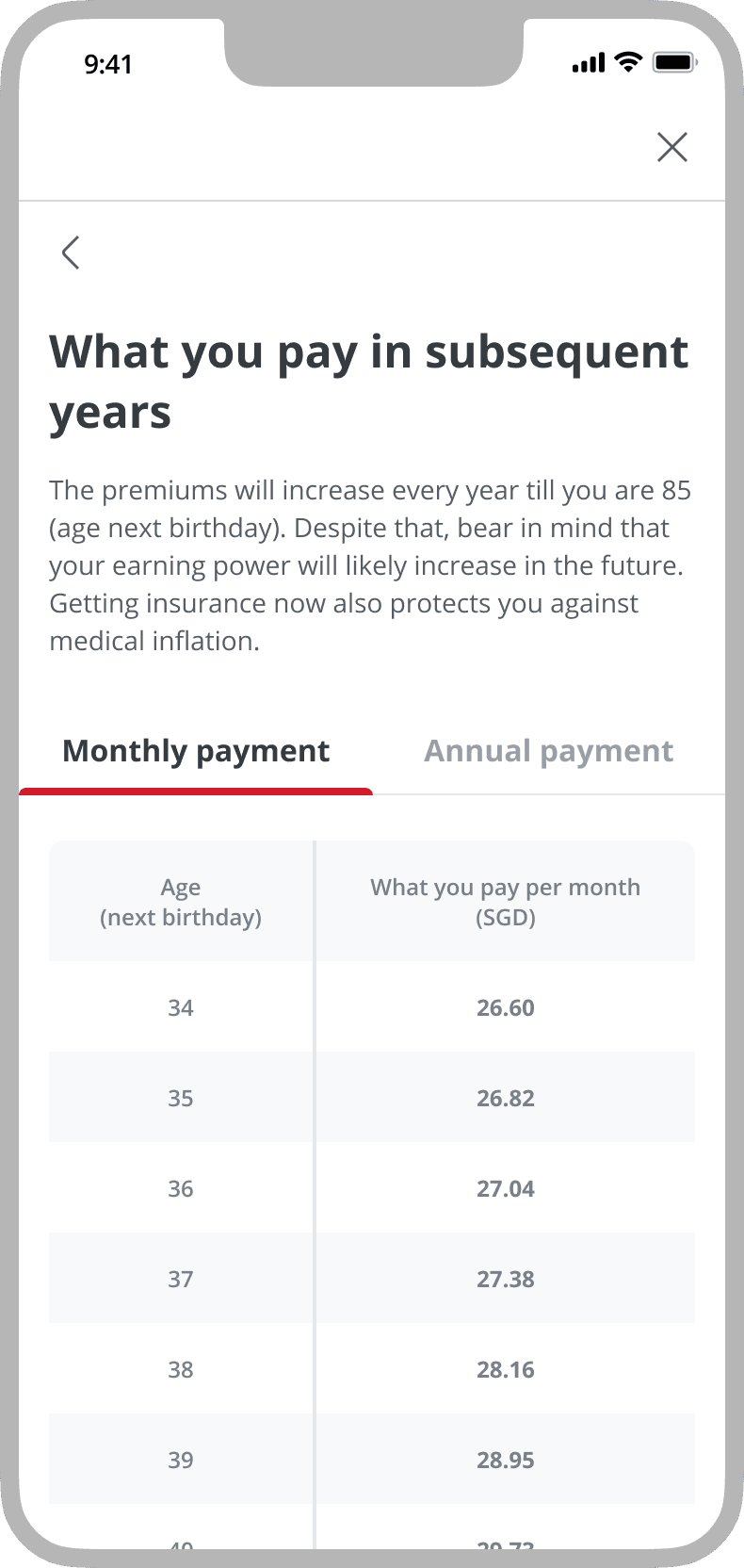

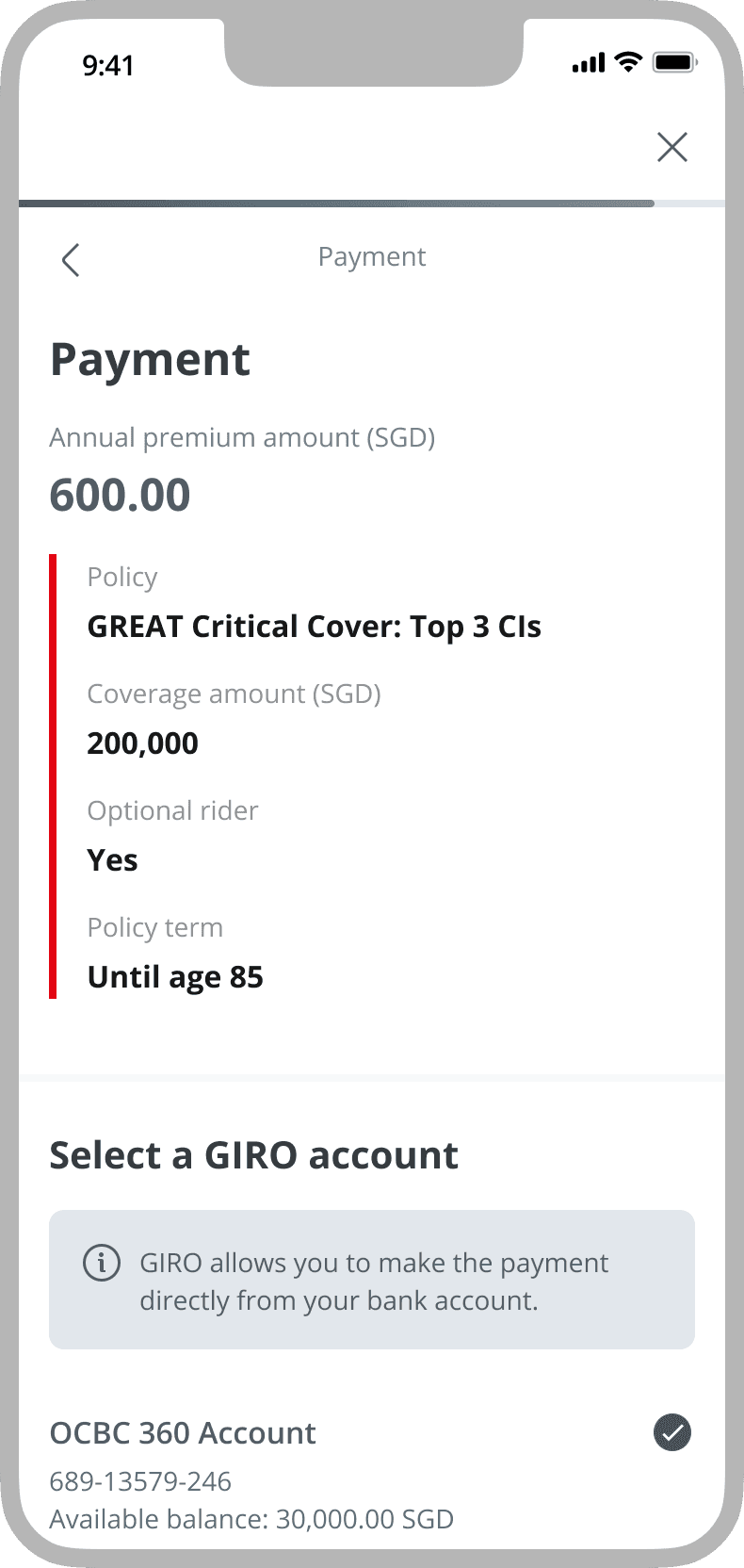

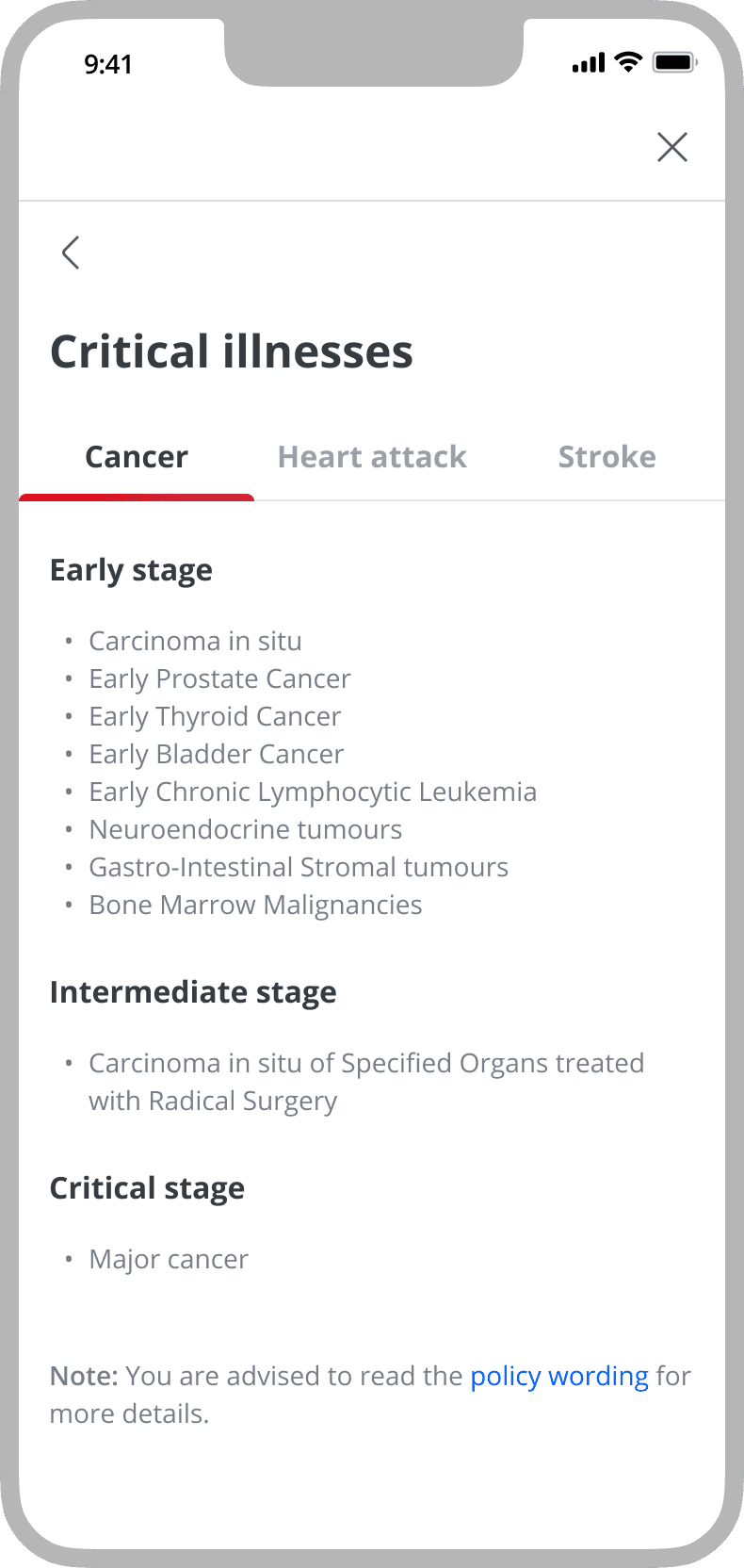

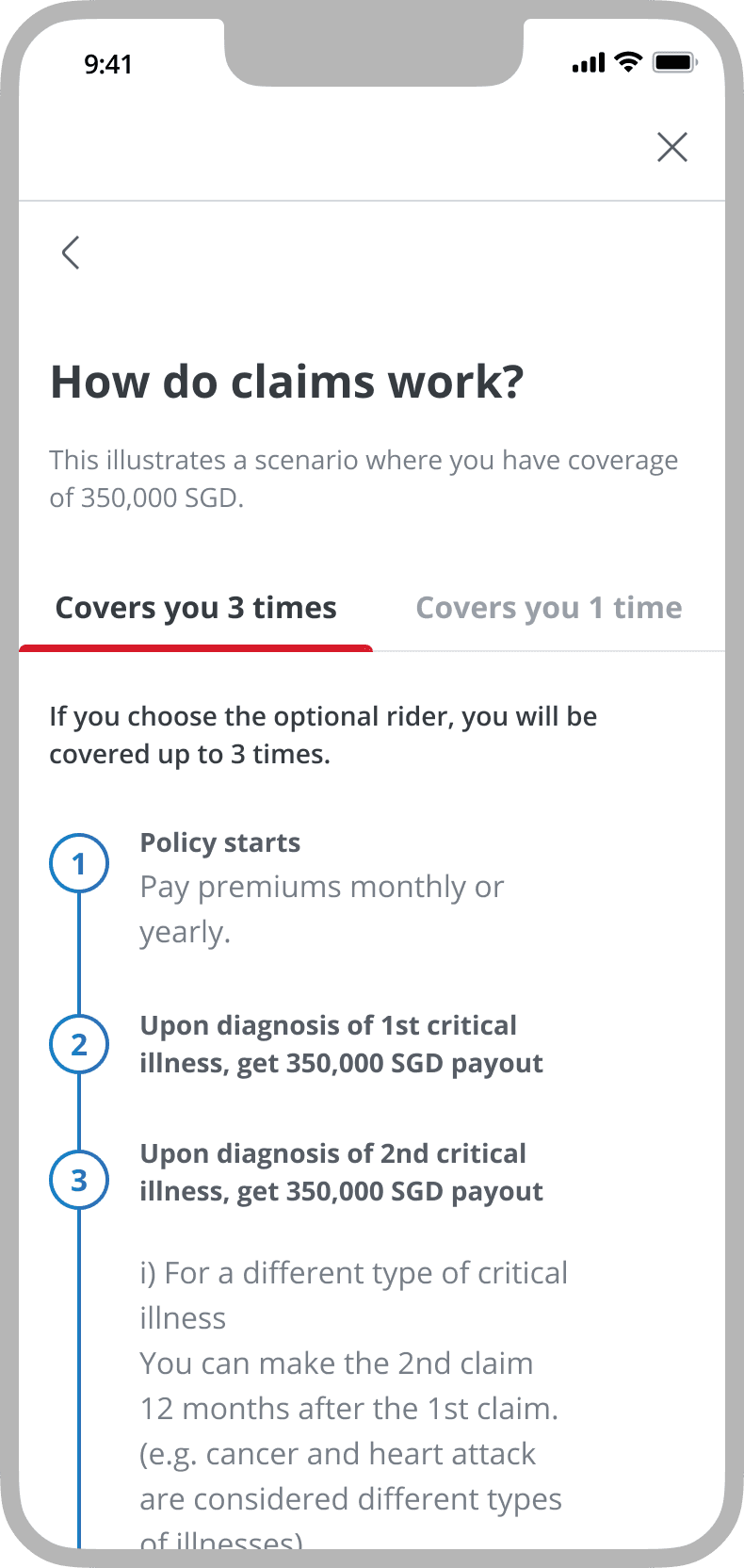

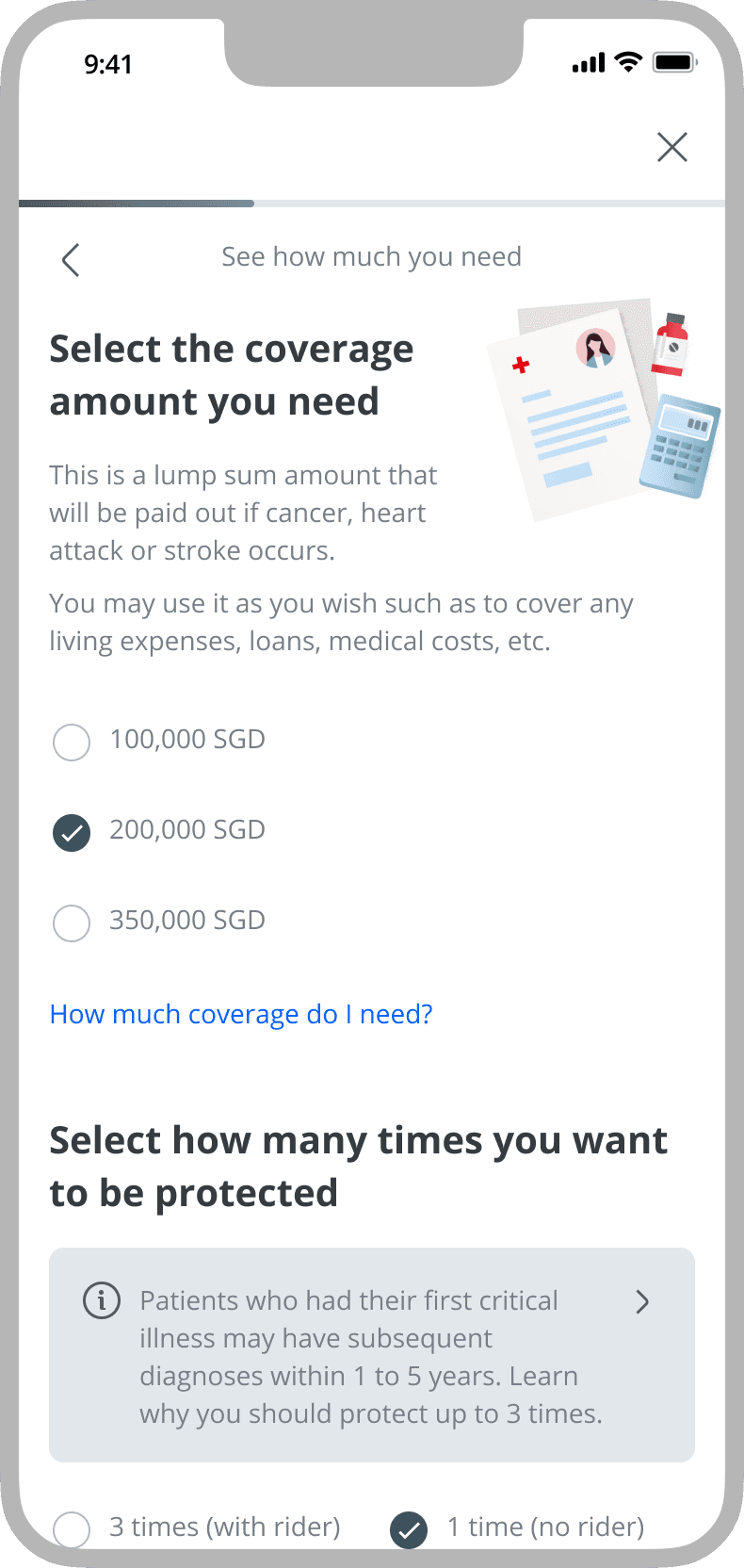

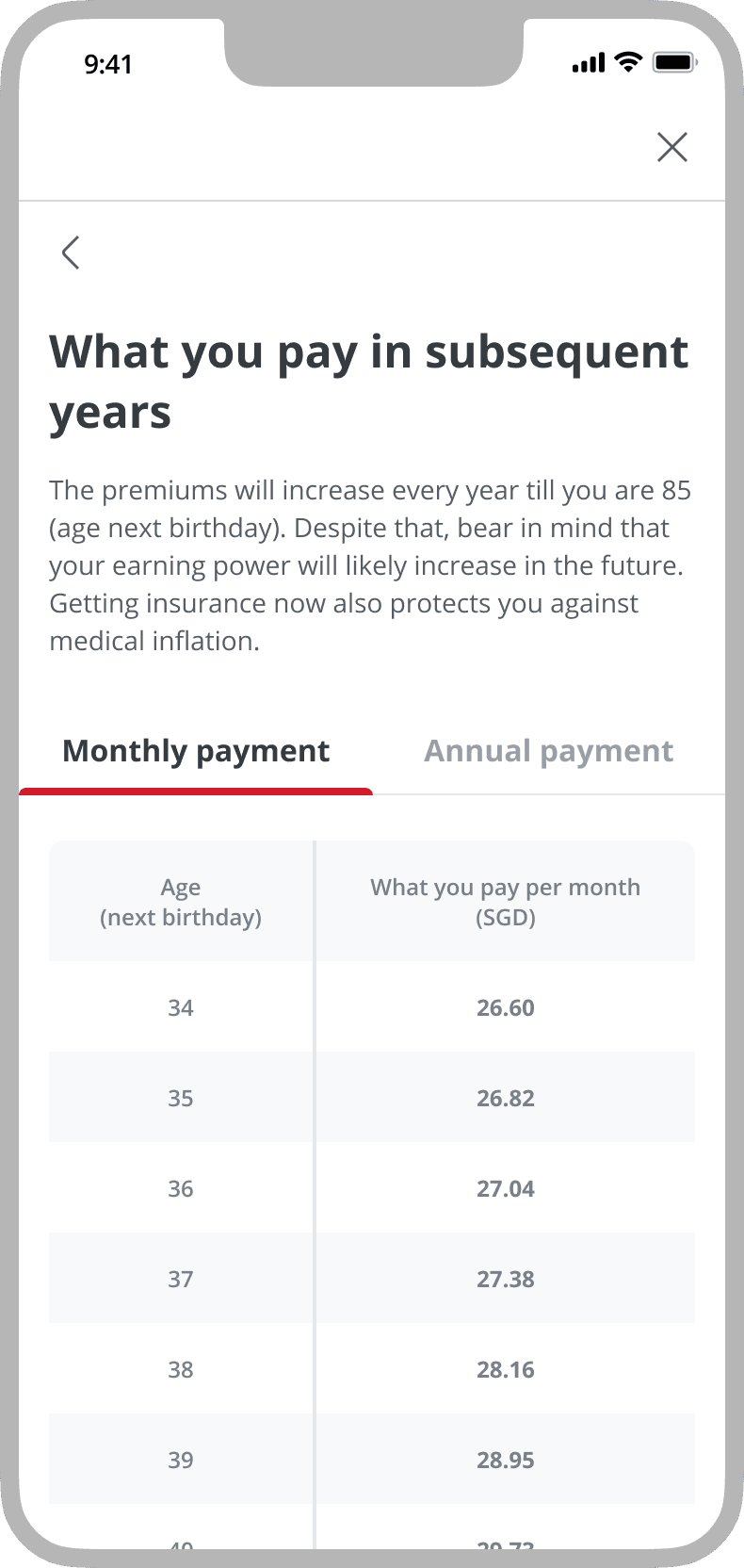

CONSIDERATION & PURCHASE

Policy Purchase Journey

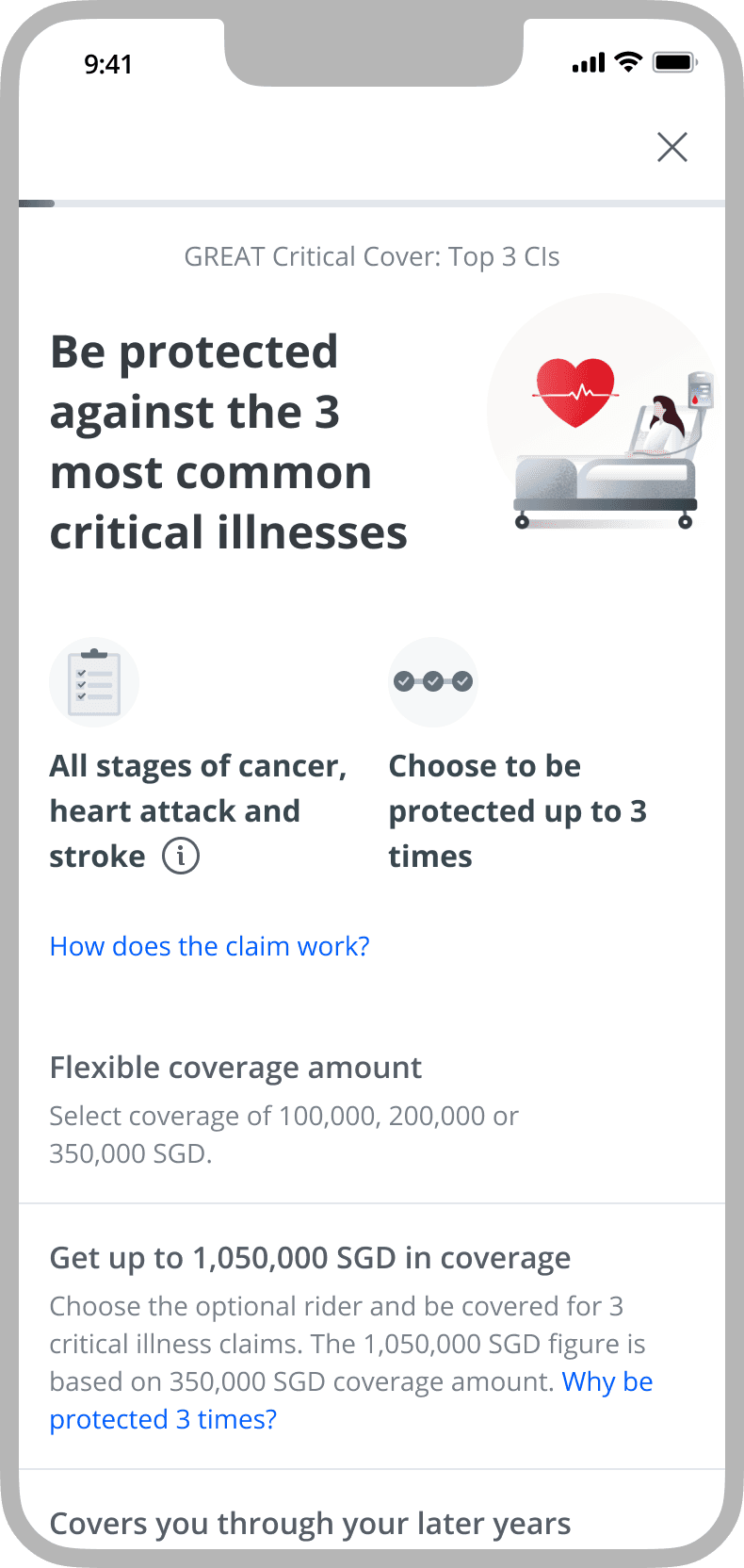

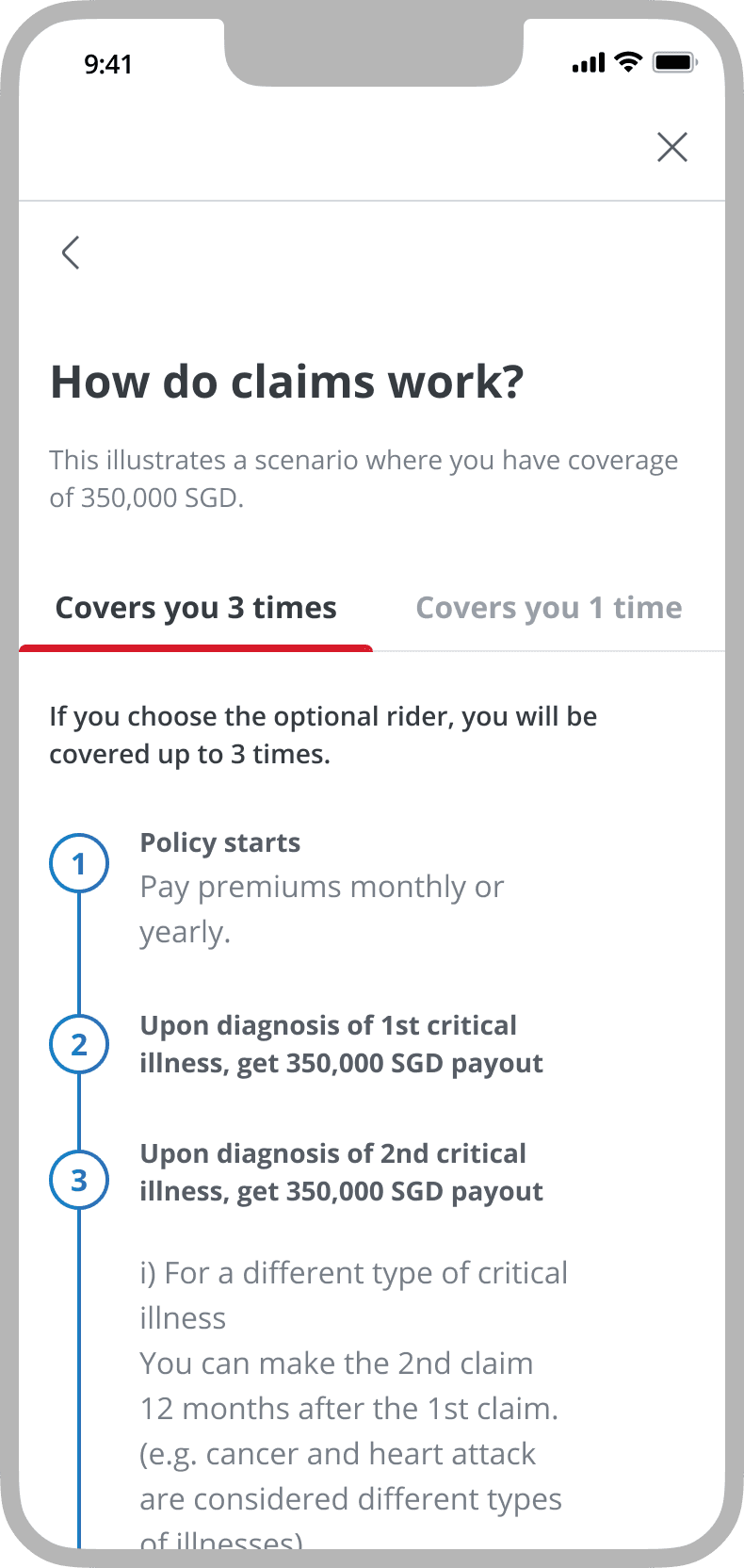

The Policy Purchase Journey refers to the journey of purchasing protection, endowment, and/or travel insurance policies on the OCBC Digital app.

Policy overview

On-demand detailed information

Policy customisation

Instant and exact premiums

Review and payment

CONSIDERATION & PURCHASE

Policy Purchase Journey

The Policy Purchase Journey refers to the journey of purchasing protection, endowment, and/or travel insurance policies on the OCBC Digital app.

Policy overview

On-demand detailed information

Policy customisation

Instant and exact premiums

Review and payment

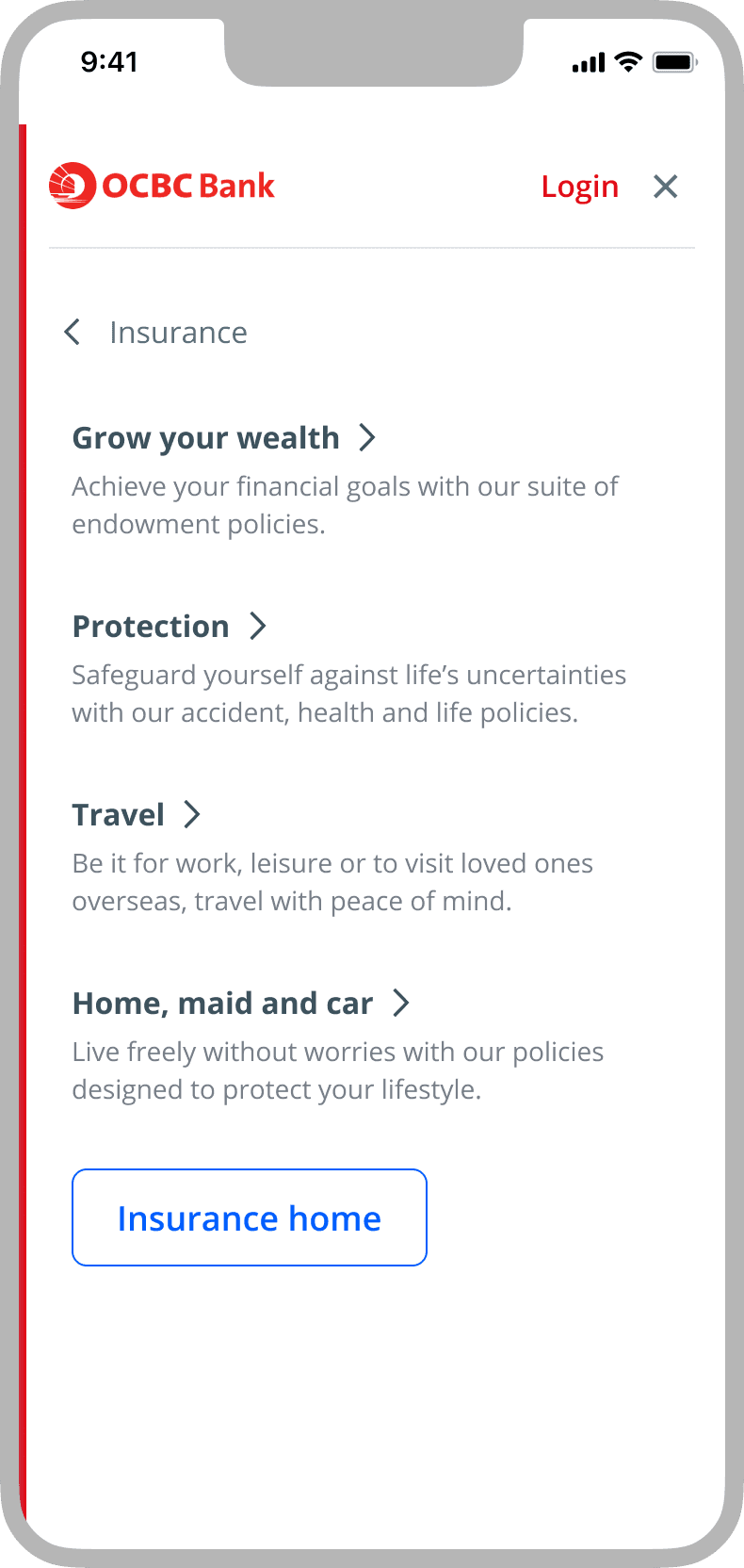

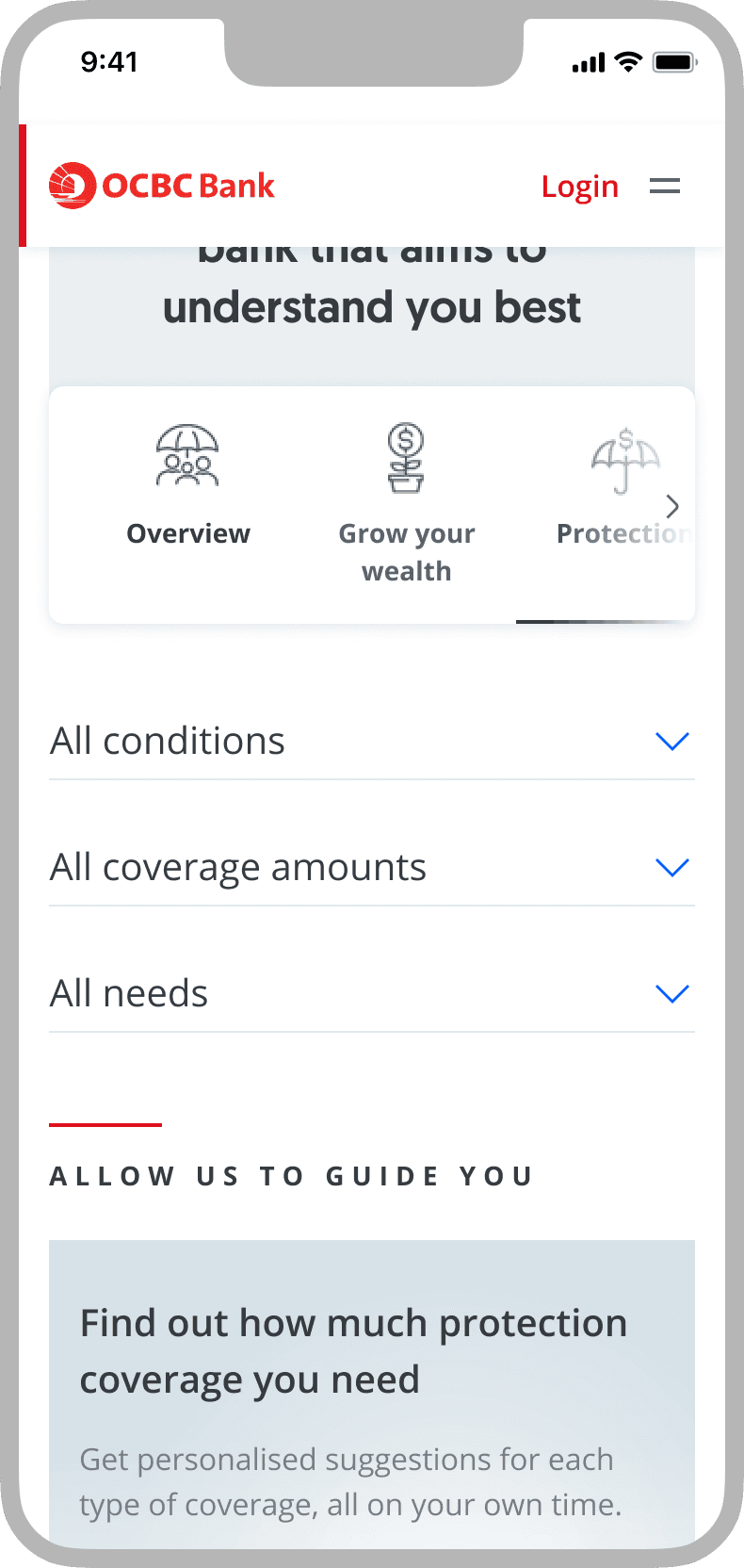

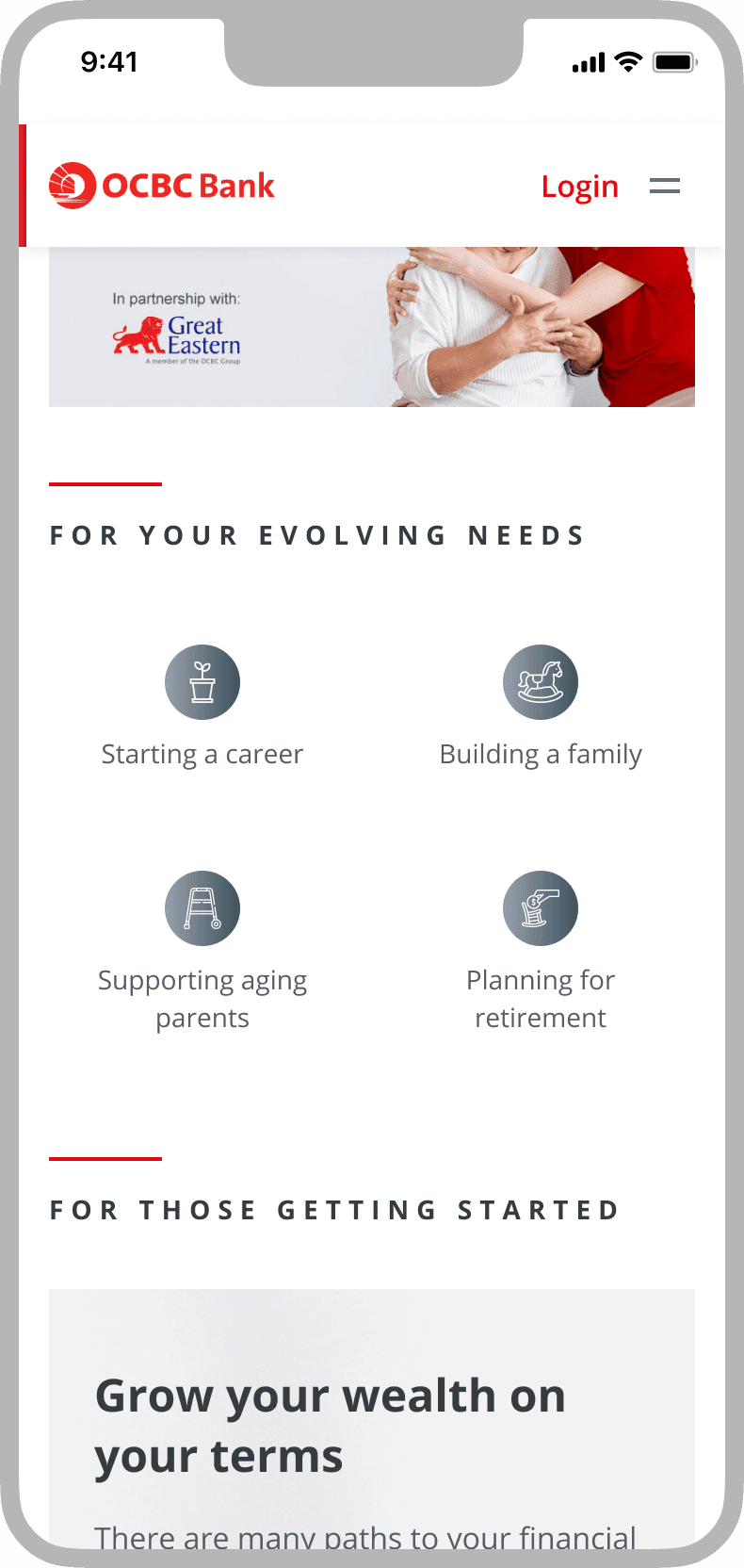

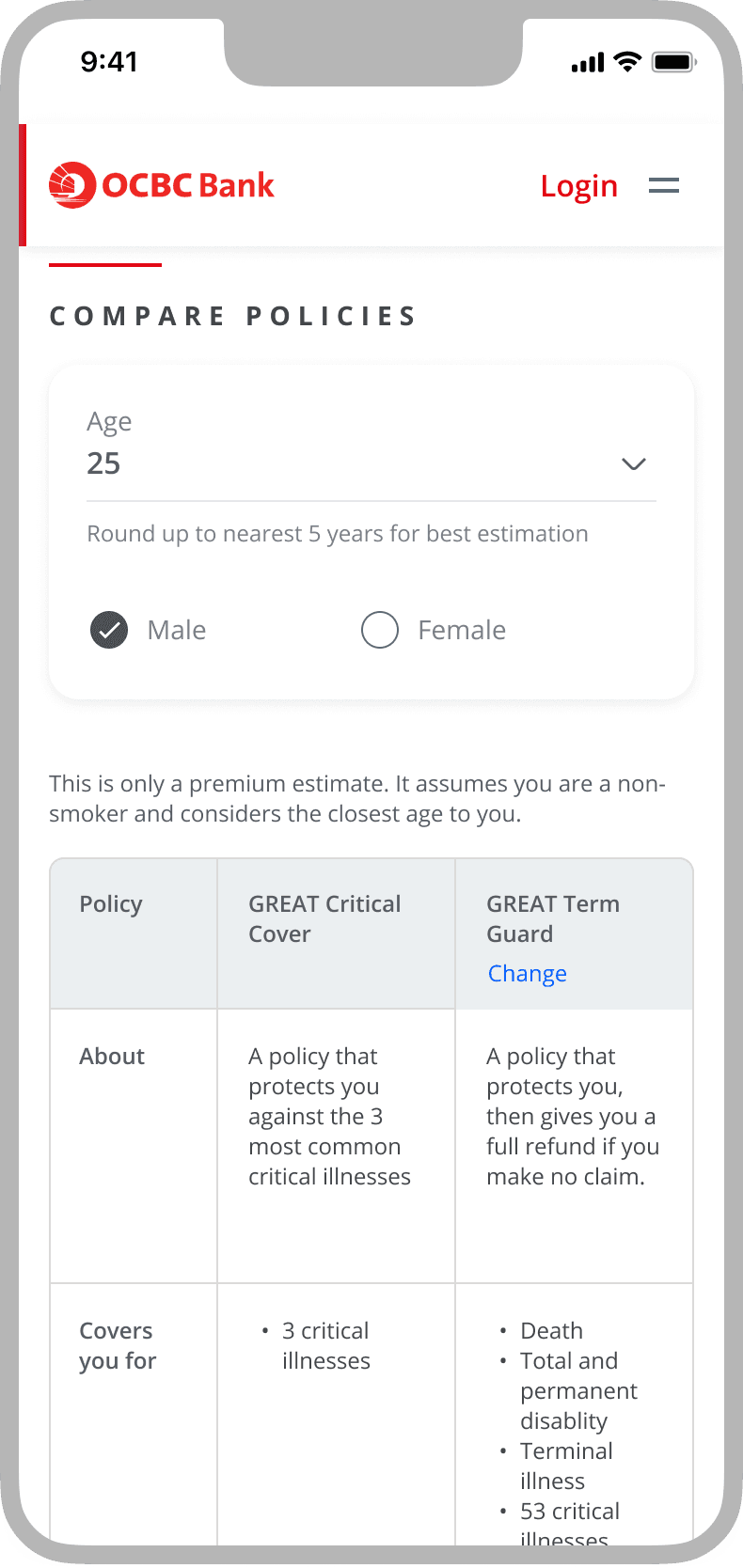

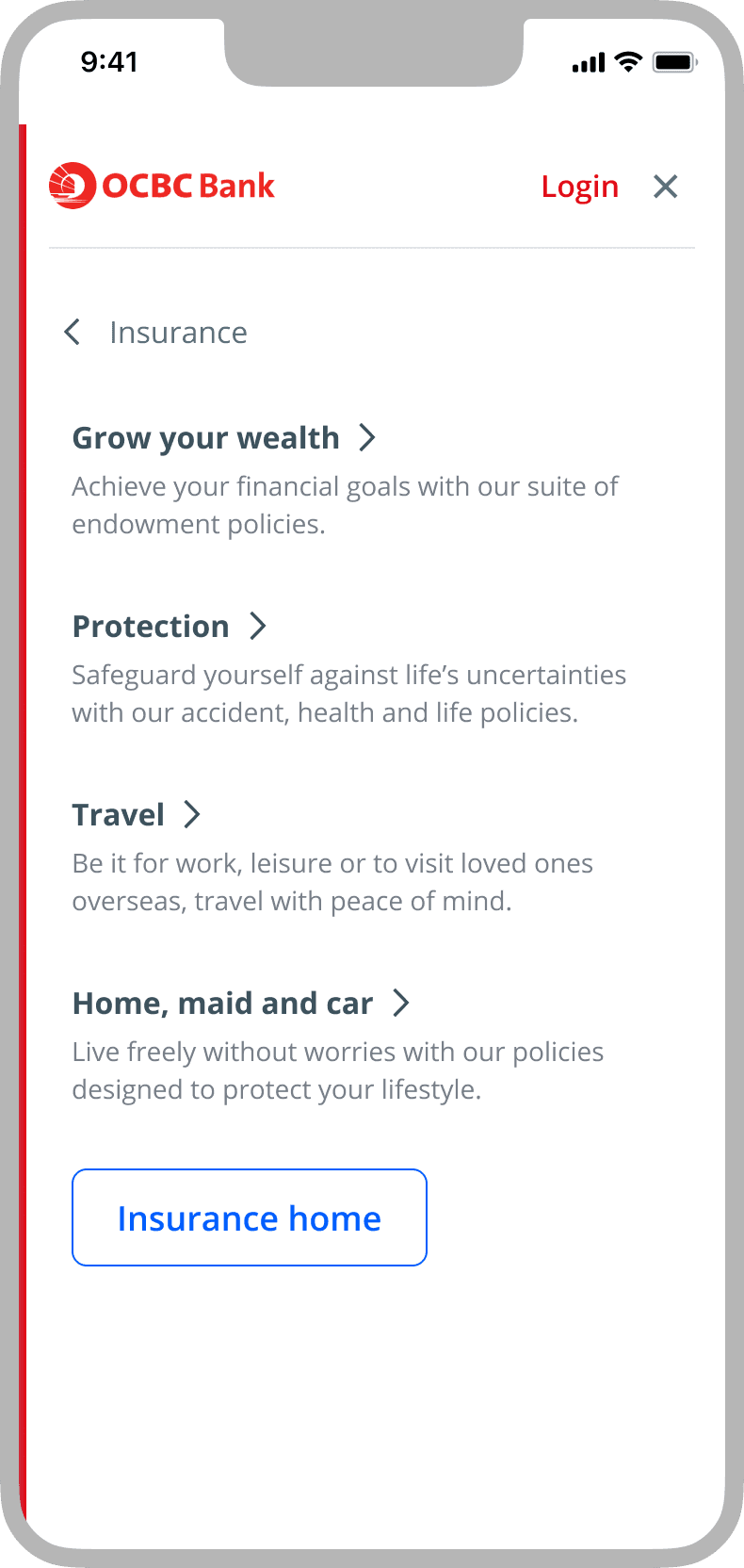

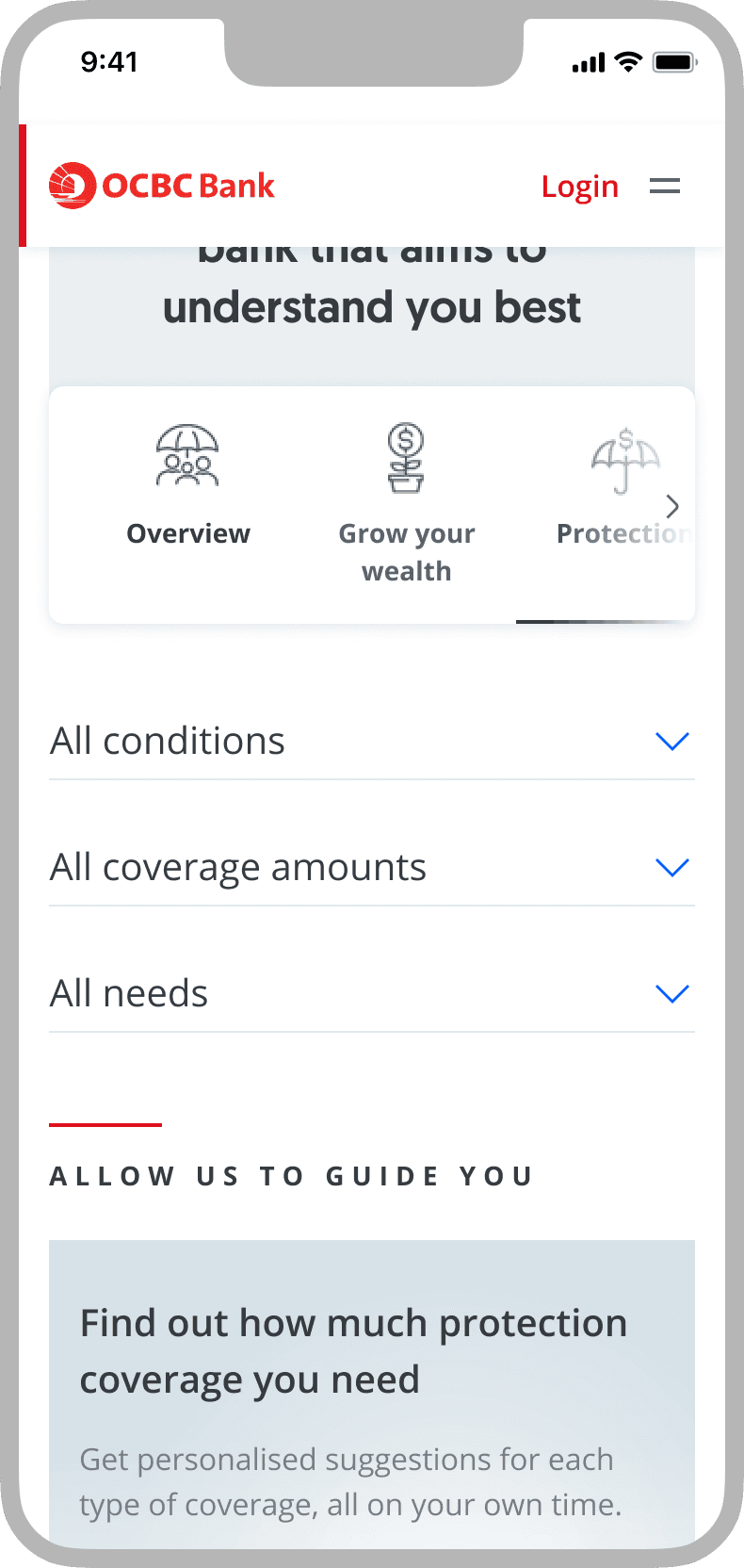

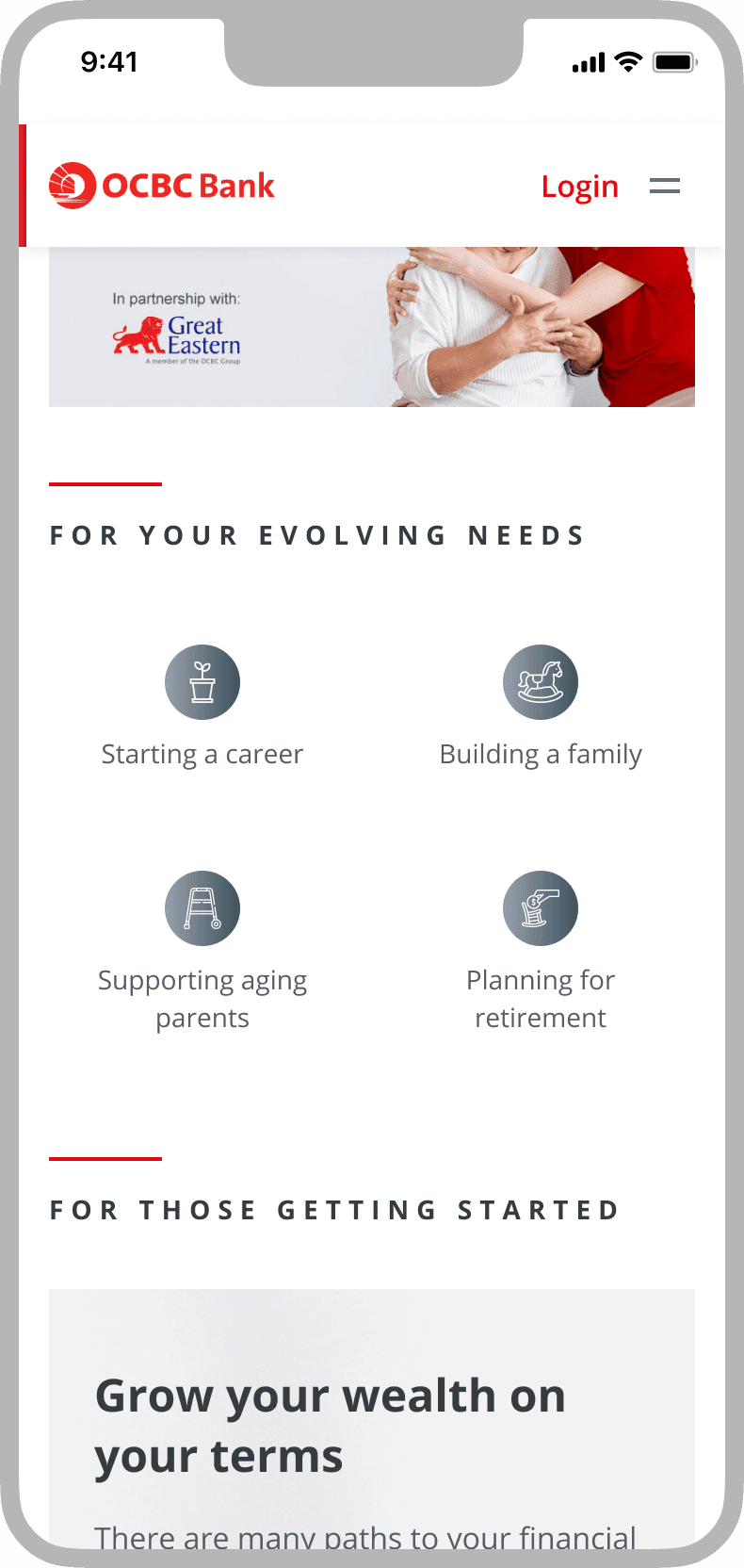

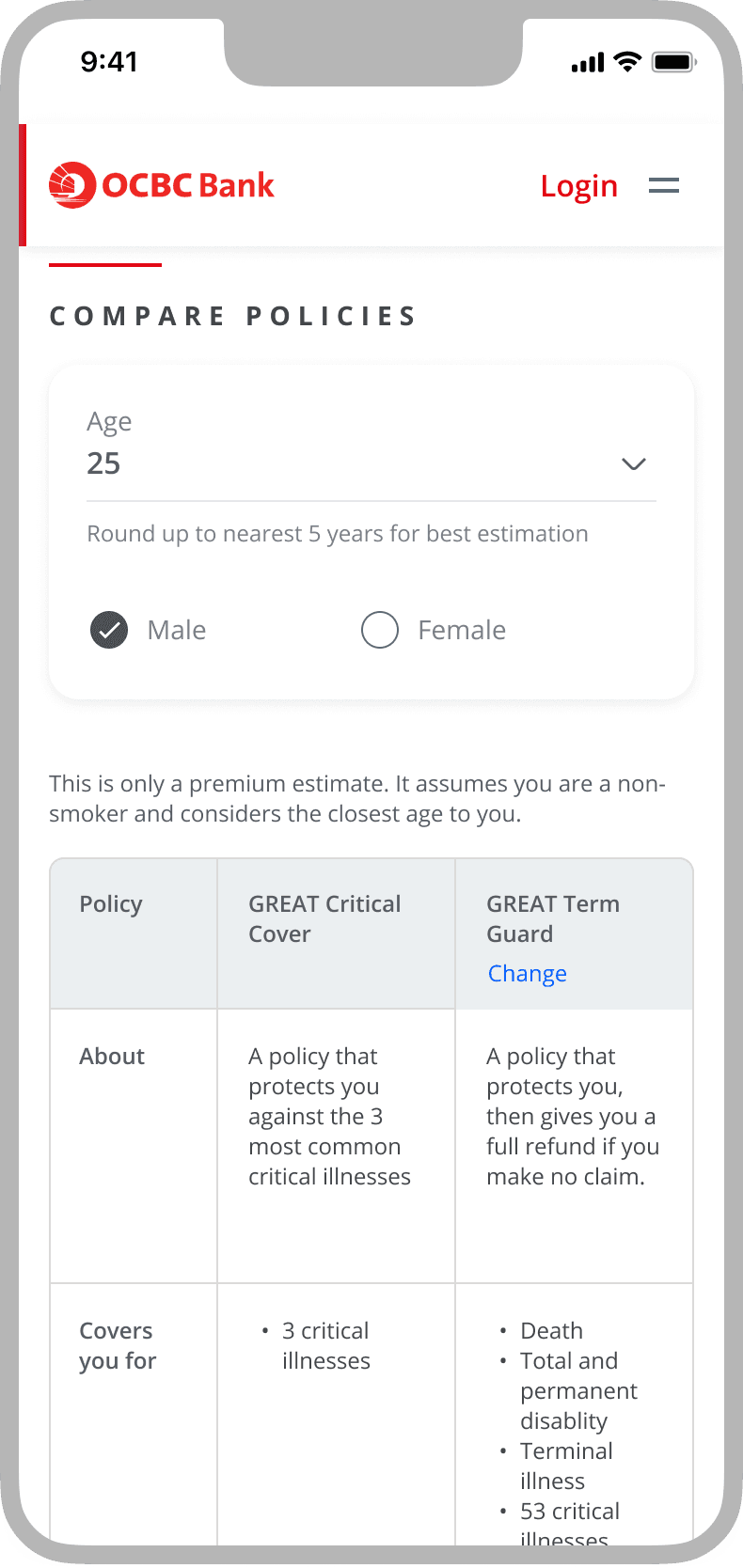

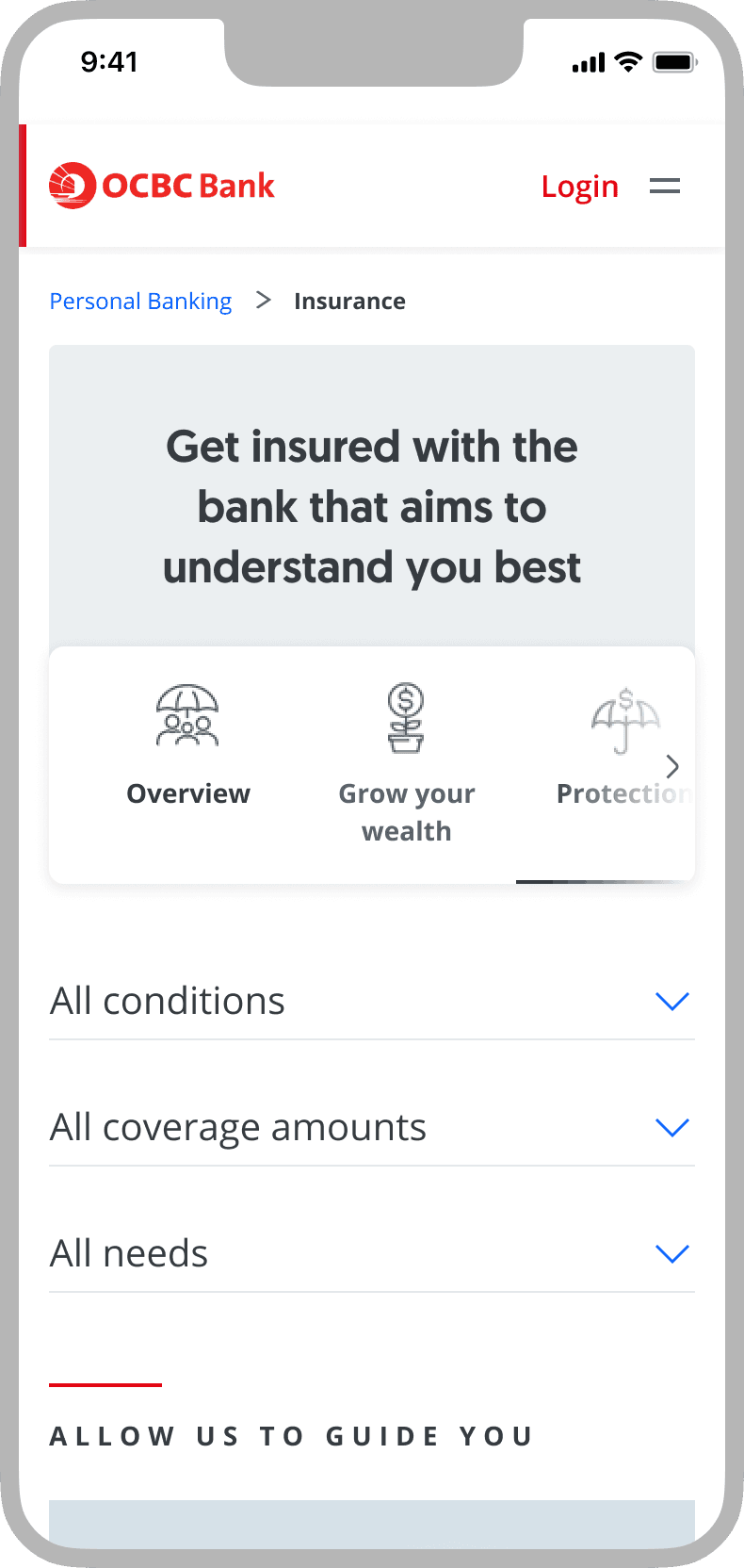

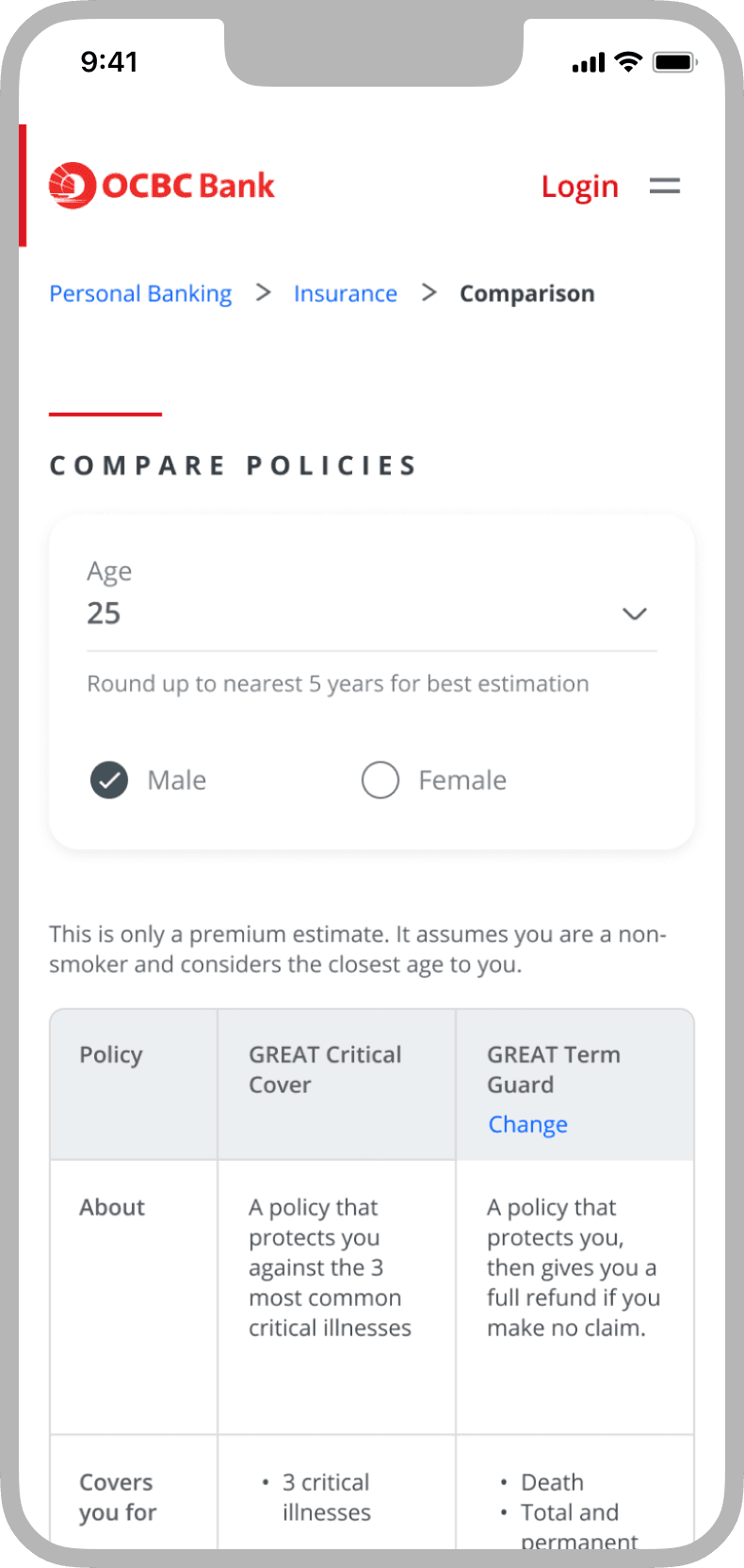

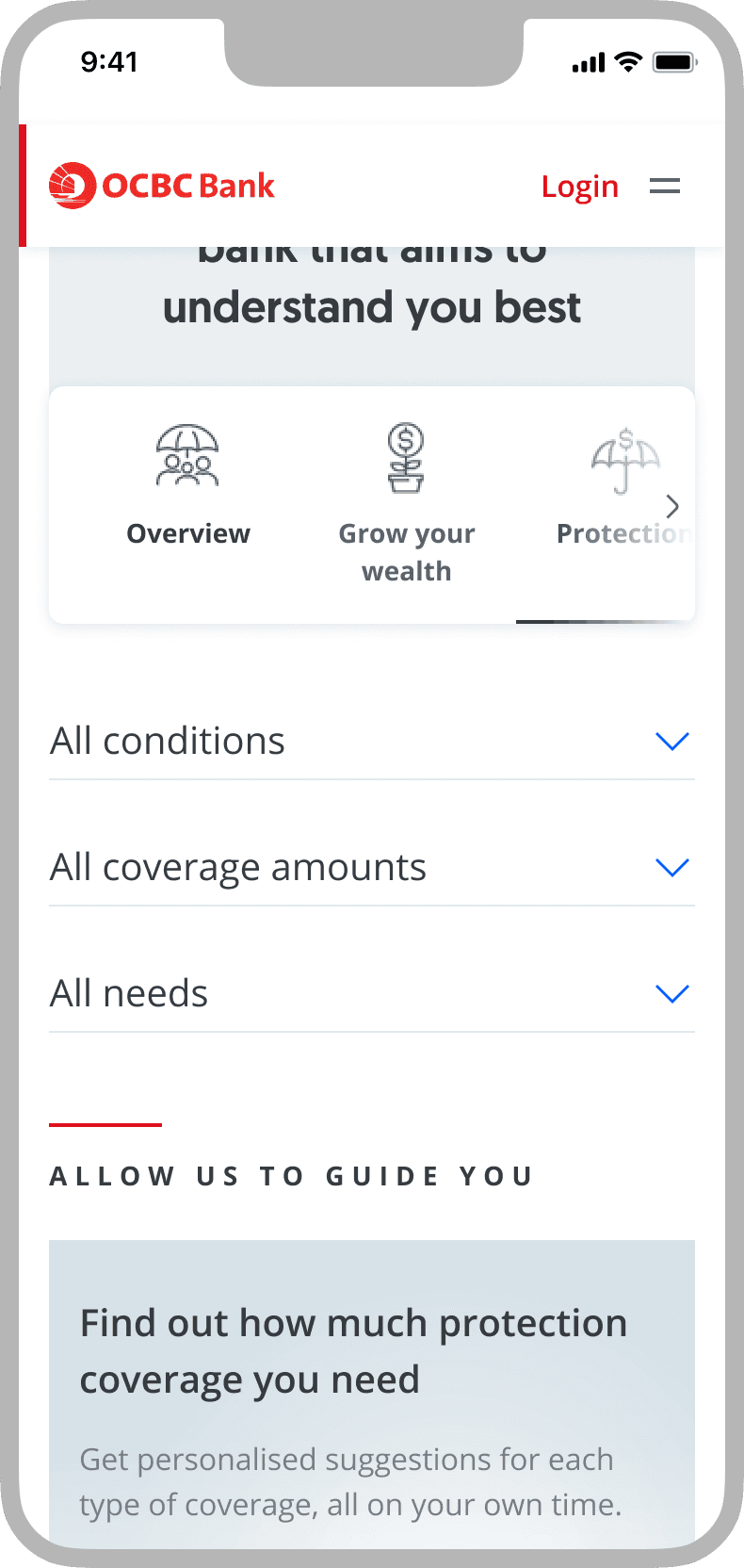

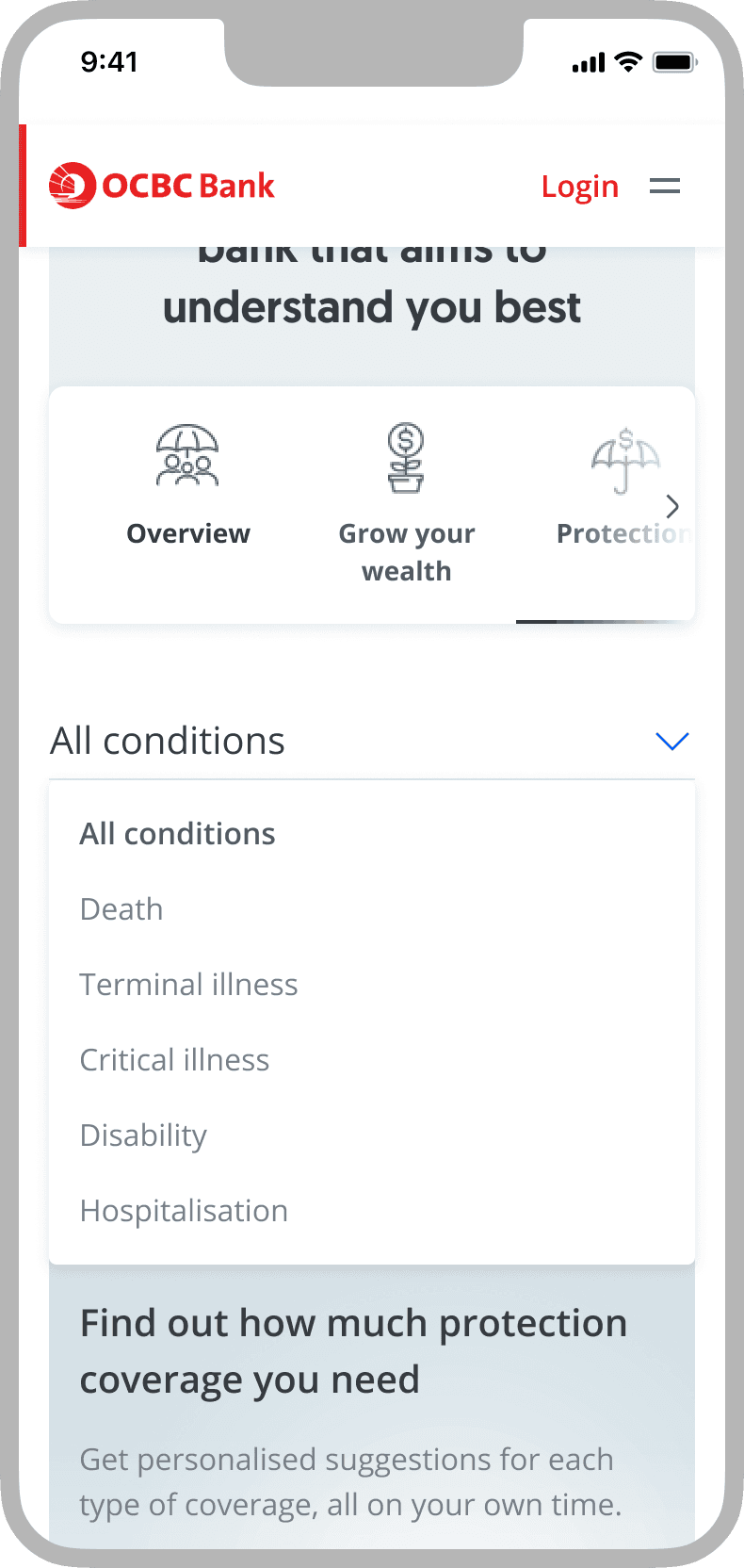

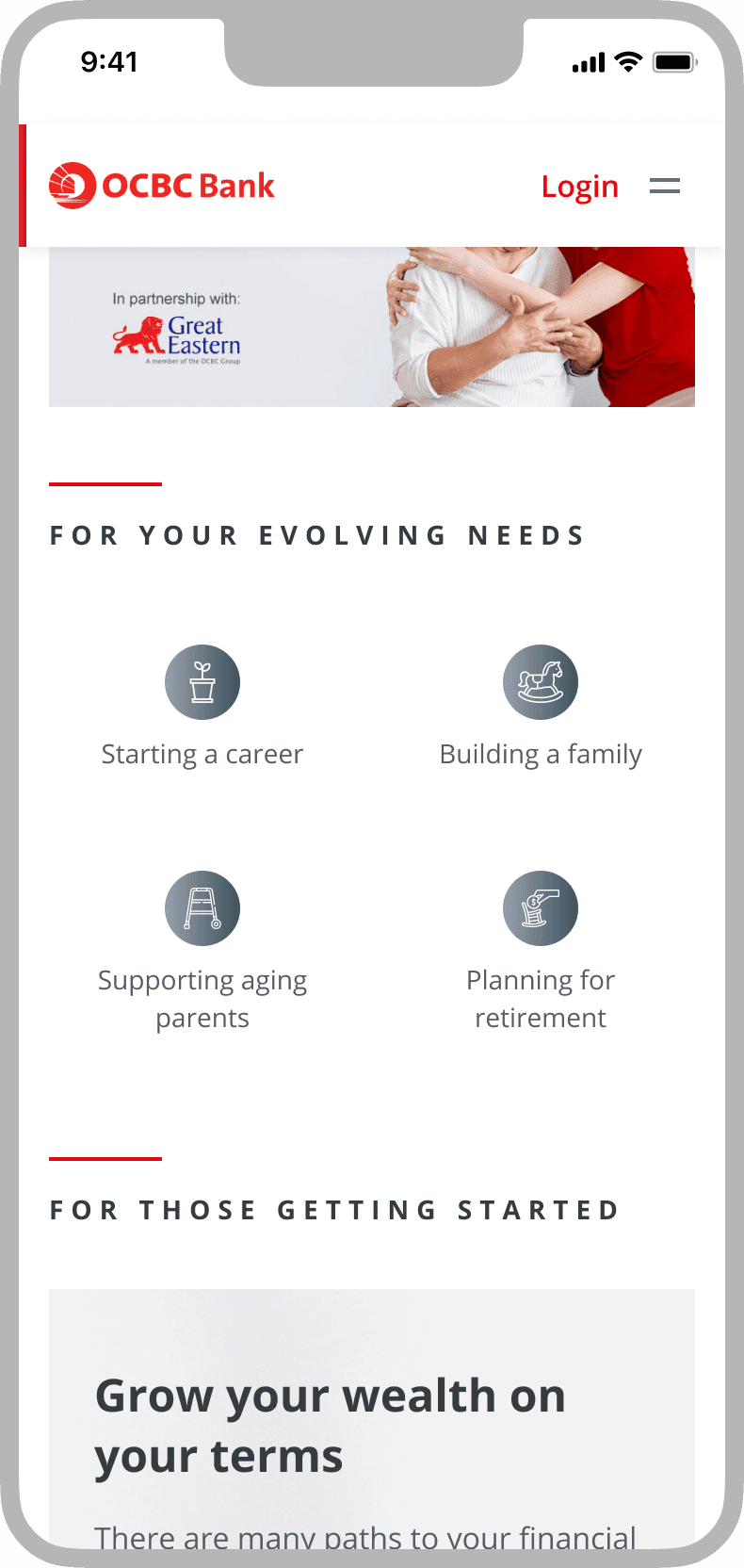

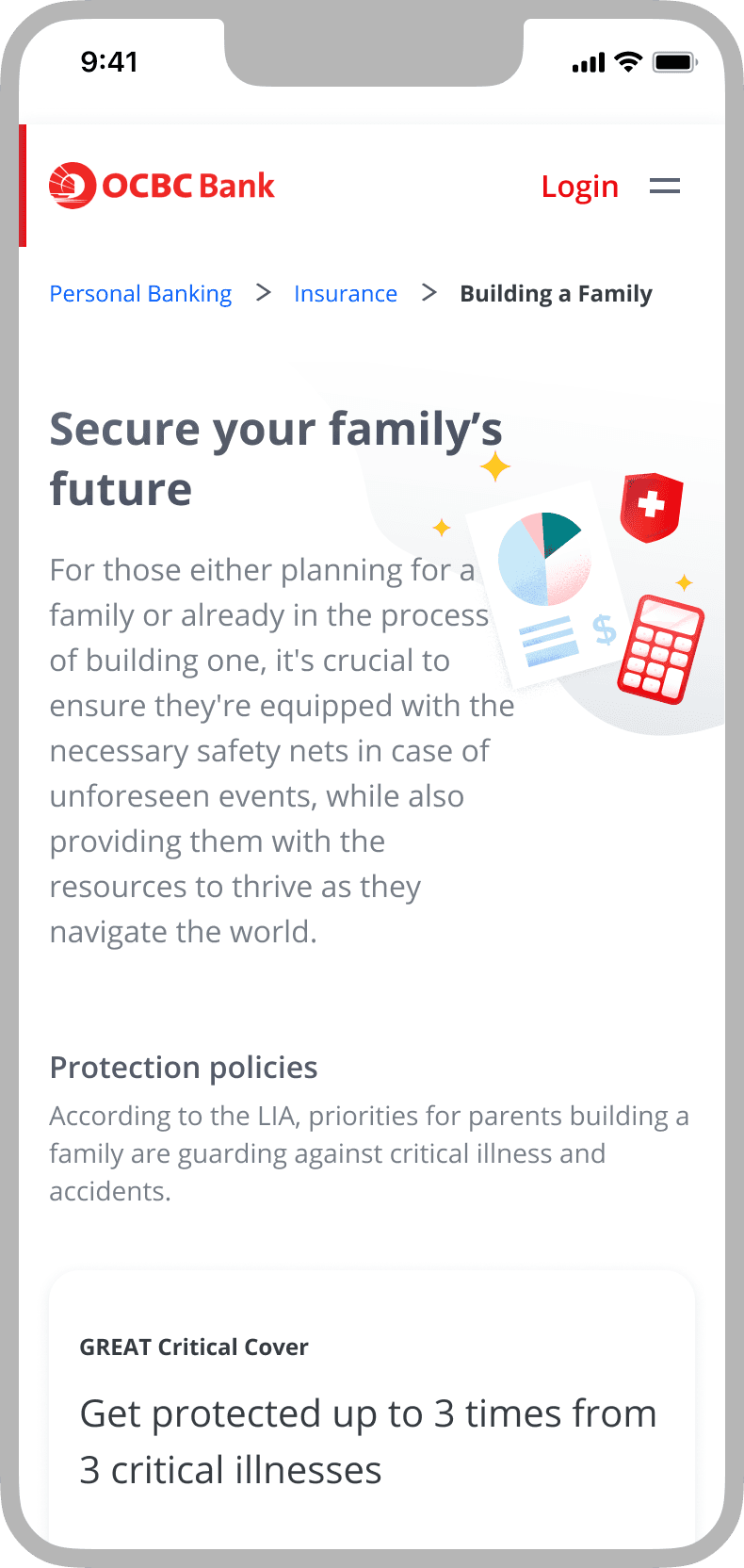

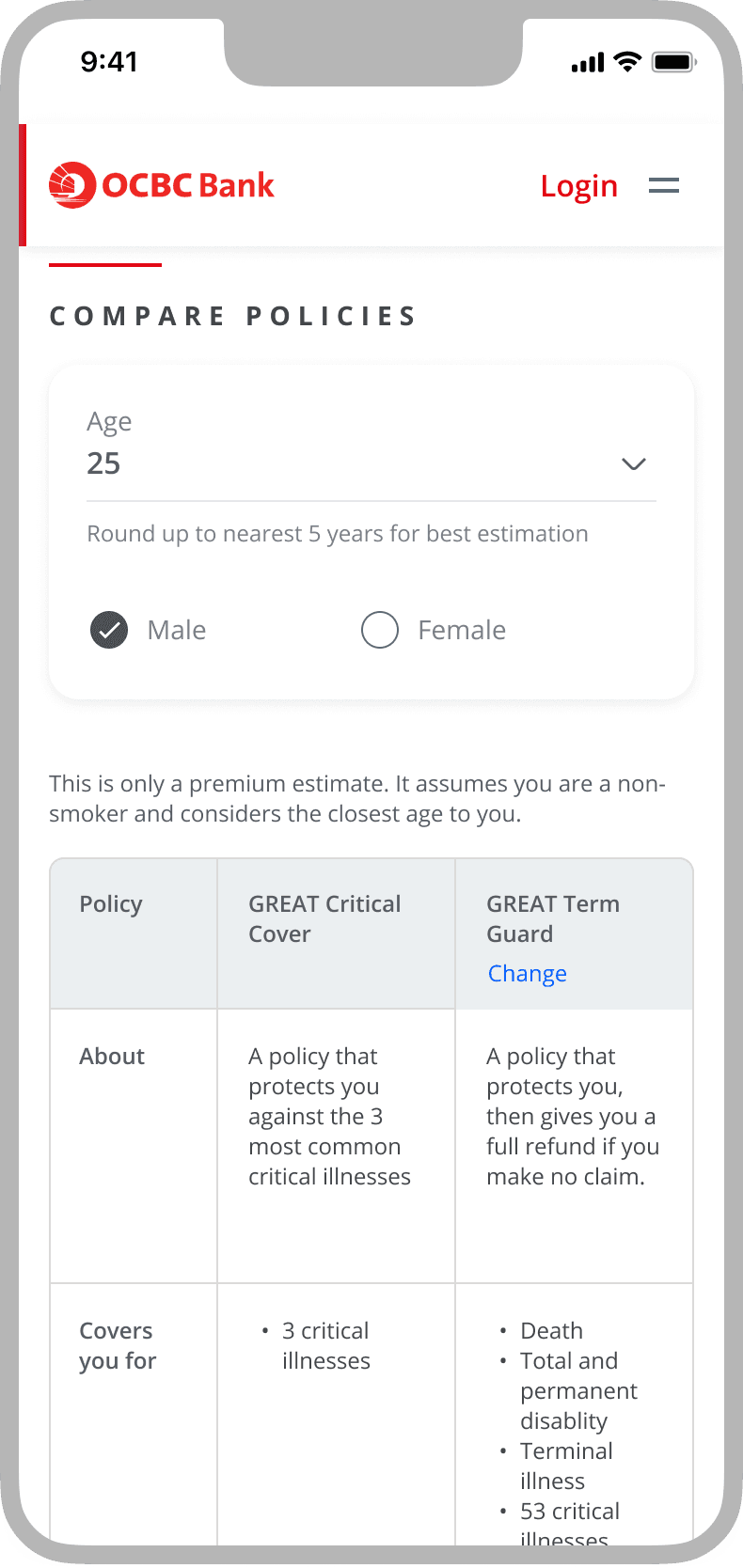

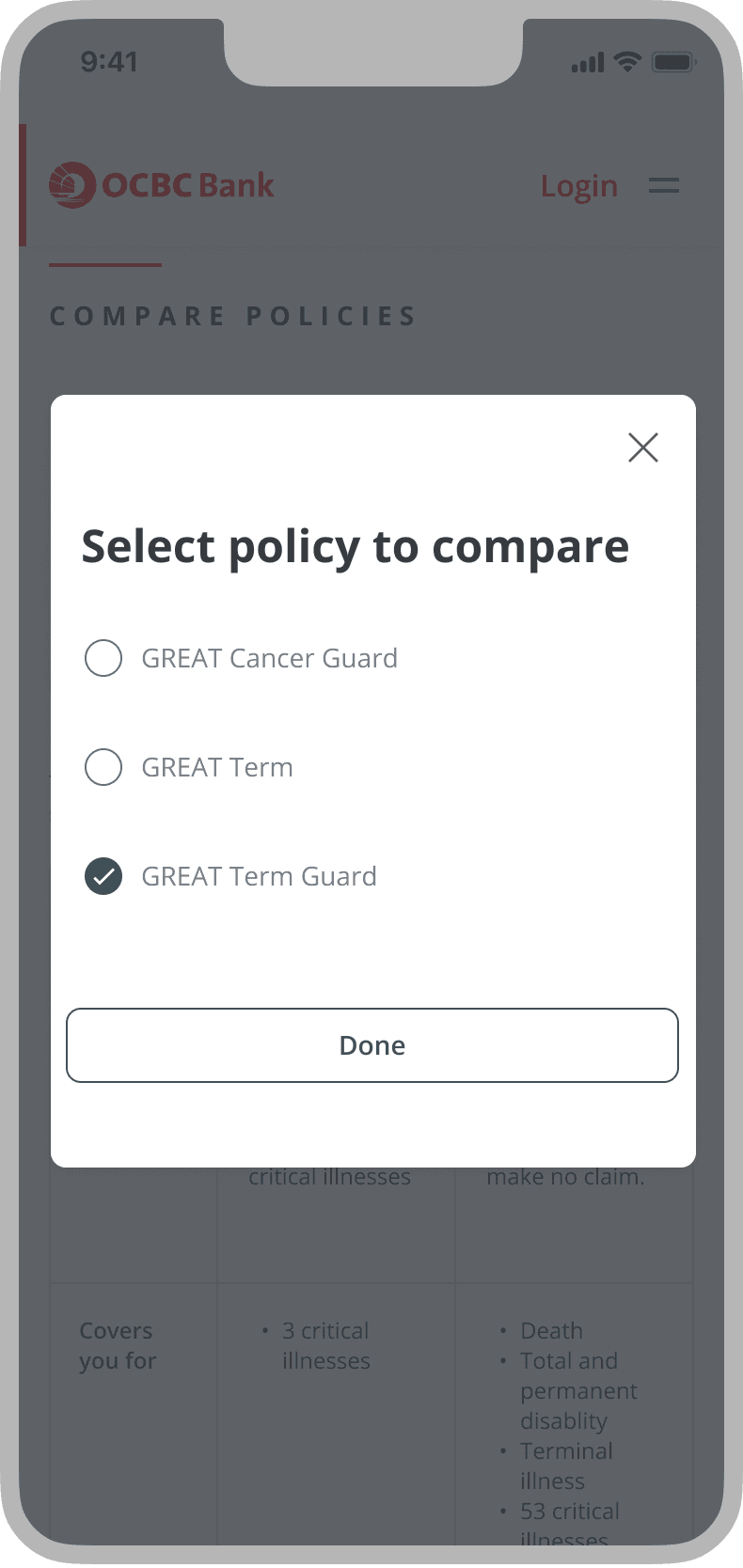

AWARENESS, DISCOVERY & CONSIDERATION

OCBC Website Insurance Section Enhancement

Enhancement of the insurance section on the OCBC website to better help customers discover and compare OCBC insurance products.

Improved navigation

Policy filtering

Needs-based discovery

Policy comparison tables

AWARENESS, DISCOVERY & CONSIDERATION

OCBC Website Insurance Section Enhancement

Enhancement of the insurance section on the OCBC website to better help customers discover and compare OCBC insurance products.

Improved navigation

Policy filtering

Needs-based discovery

Policy comparison tables

Overview

Guided Journey

This feature in the OCBC Digital app provides customers with the convenience of viewing all their insurance policies from different providers in one place. It also empowers users to easily identify and address any gaps in their protection coverage across various aspects of insurance.

Awareness

Discovery

01/04

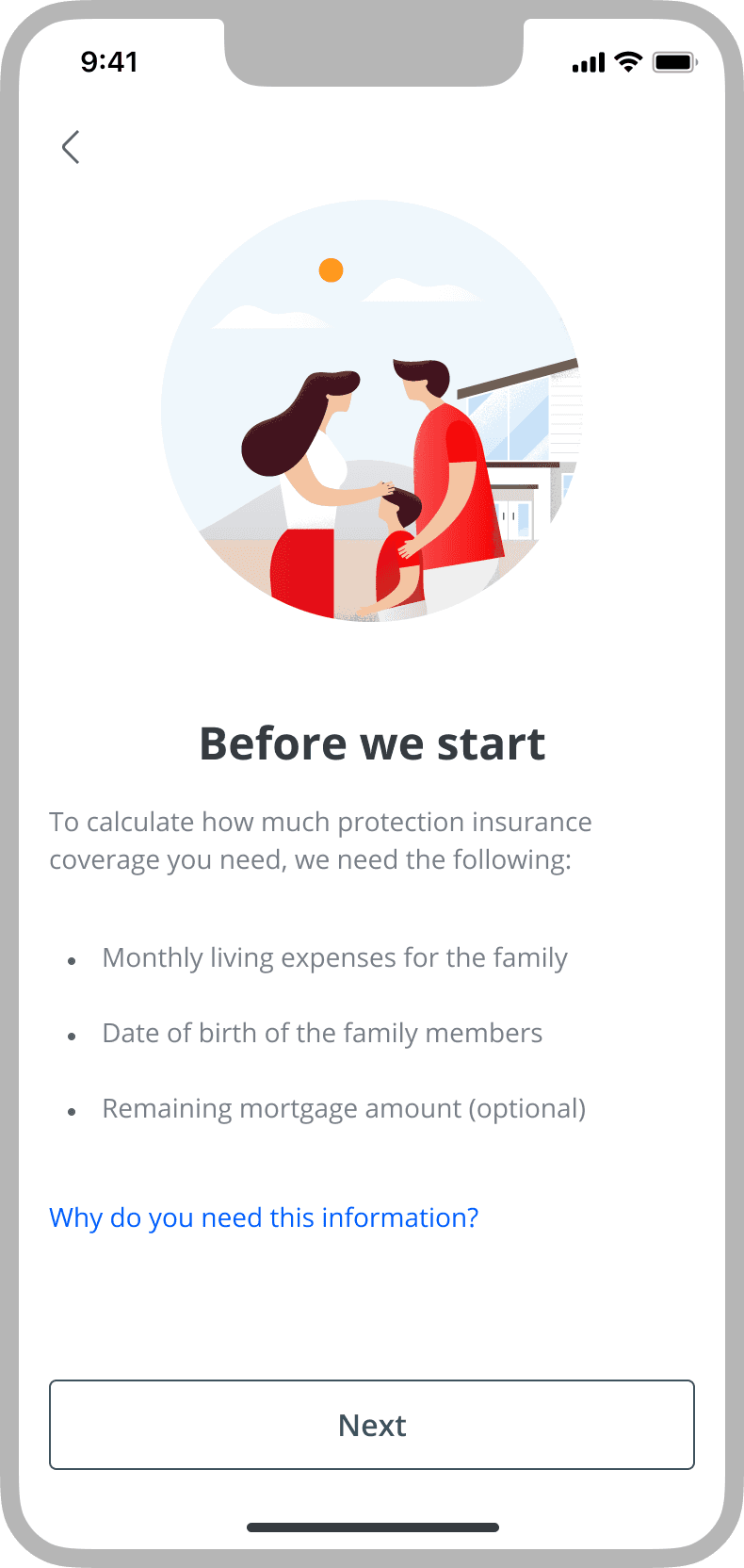

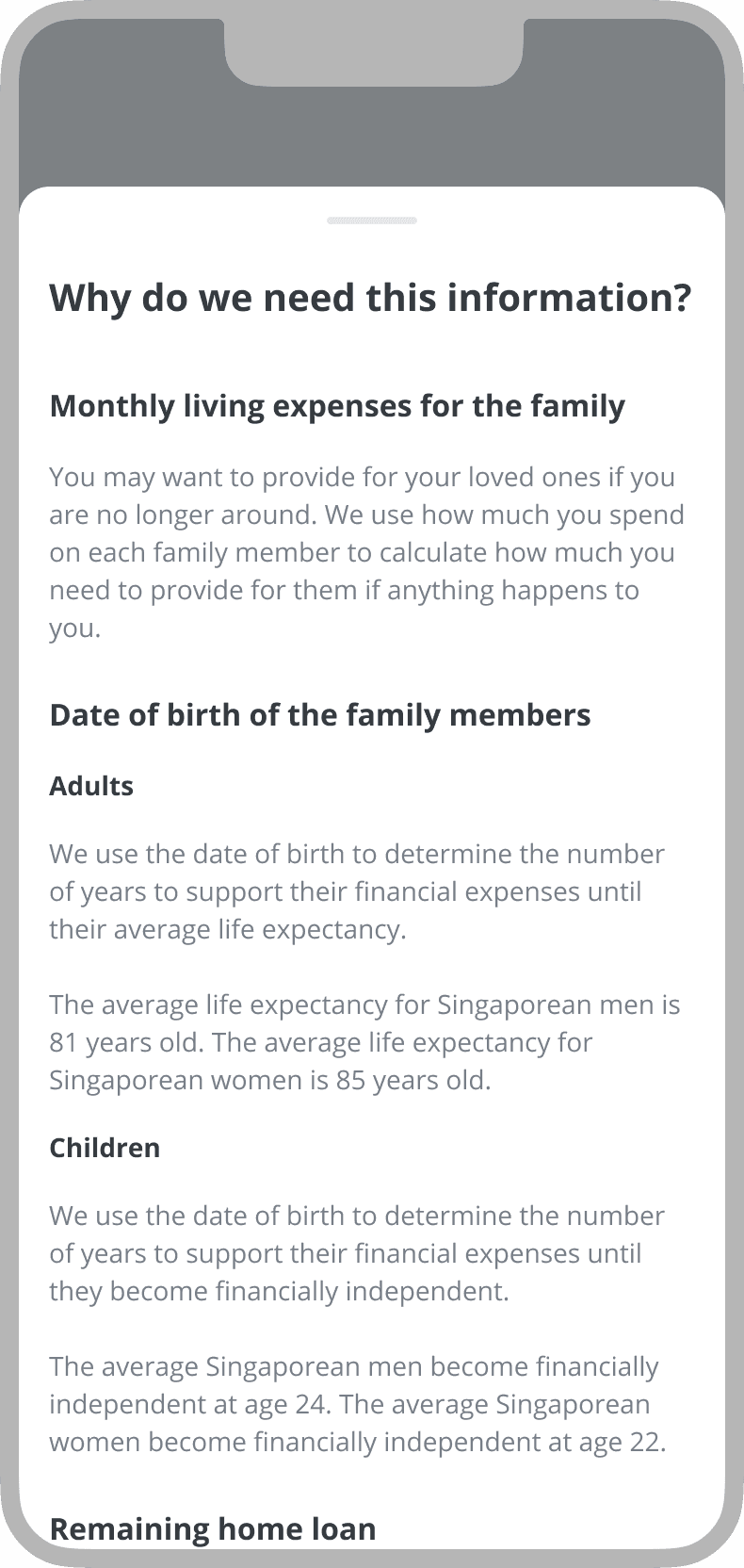

Walkthrough

A brief walkthrough for users exploring the feature for the first time.

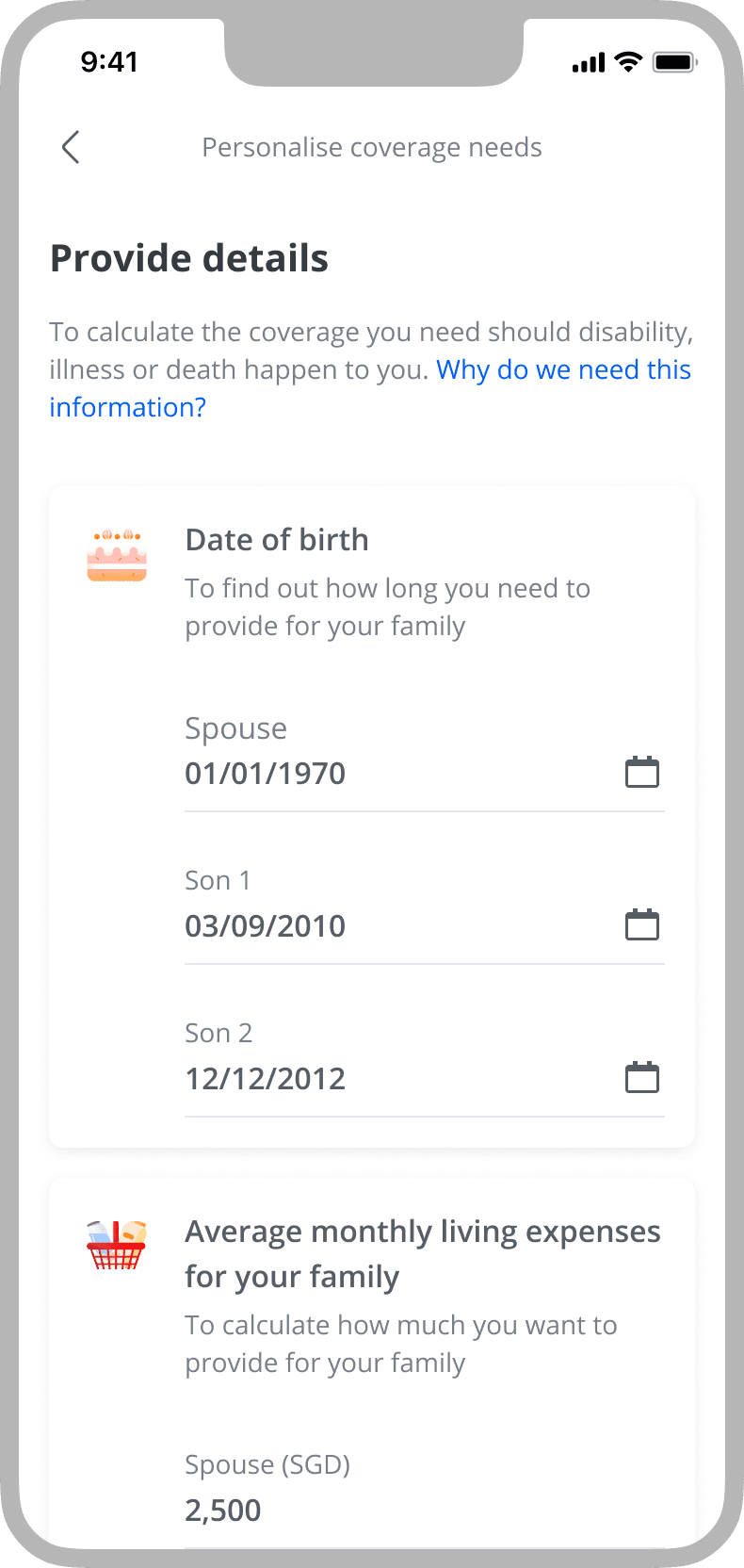

02/04

Input Details

Inviting customers to input their details to receive accurate estimates.

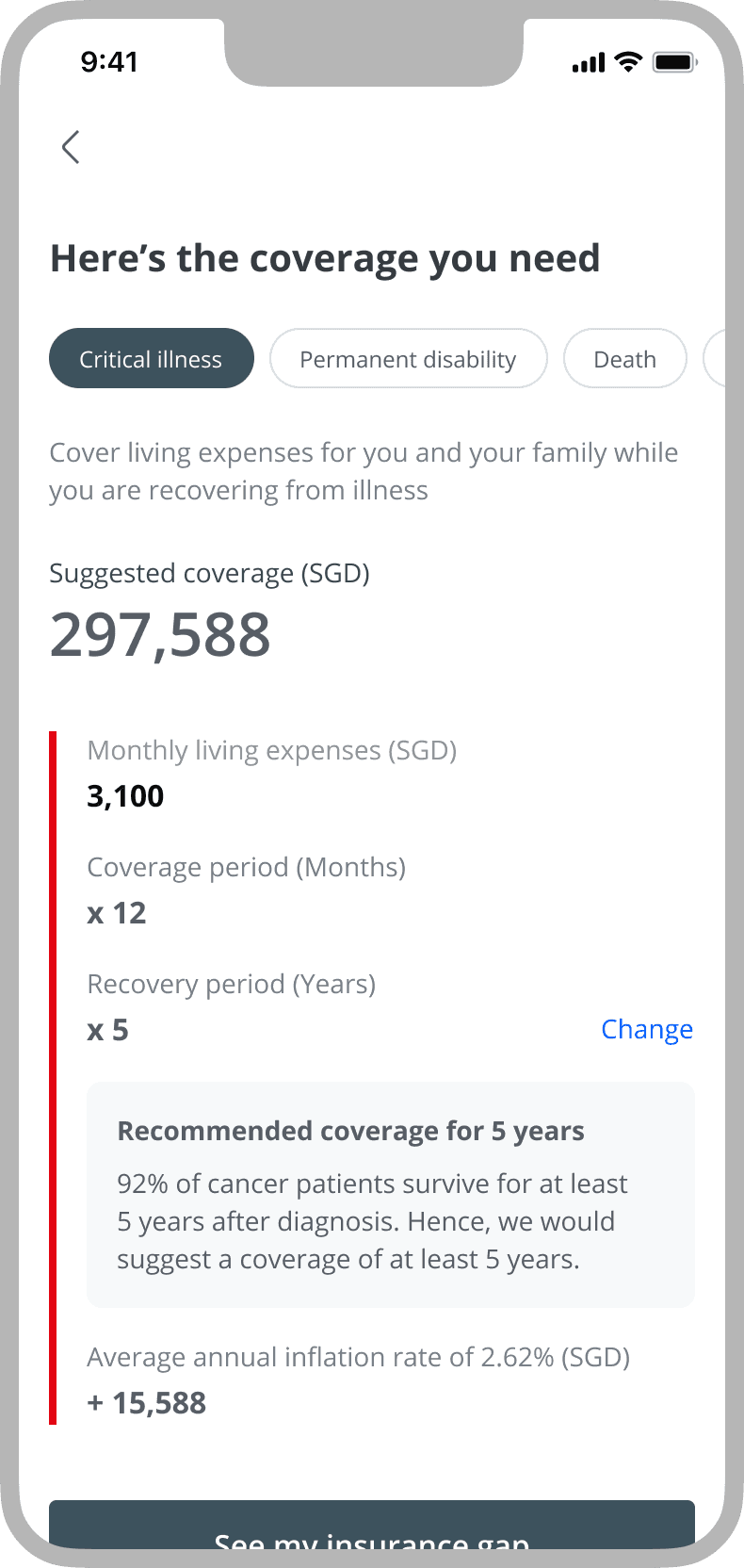

03/04

Results

Customers can see their suggested coverage amounts by category and how the amounts were derived.

04/04

Personalised Dashboard

A dashboard showing customers their active insurance policies alongside their insurance gaps for convenient comparison.

Overview

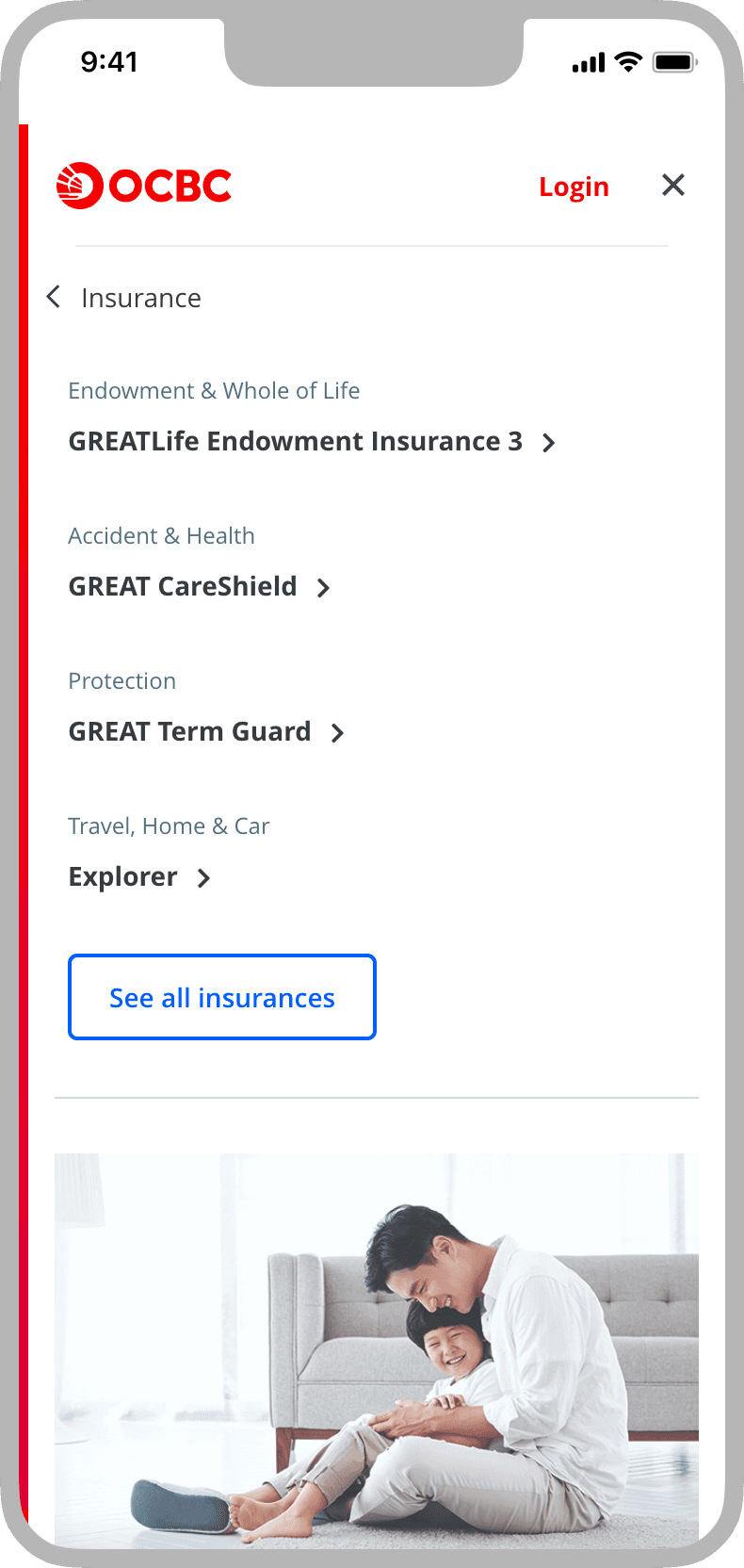

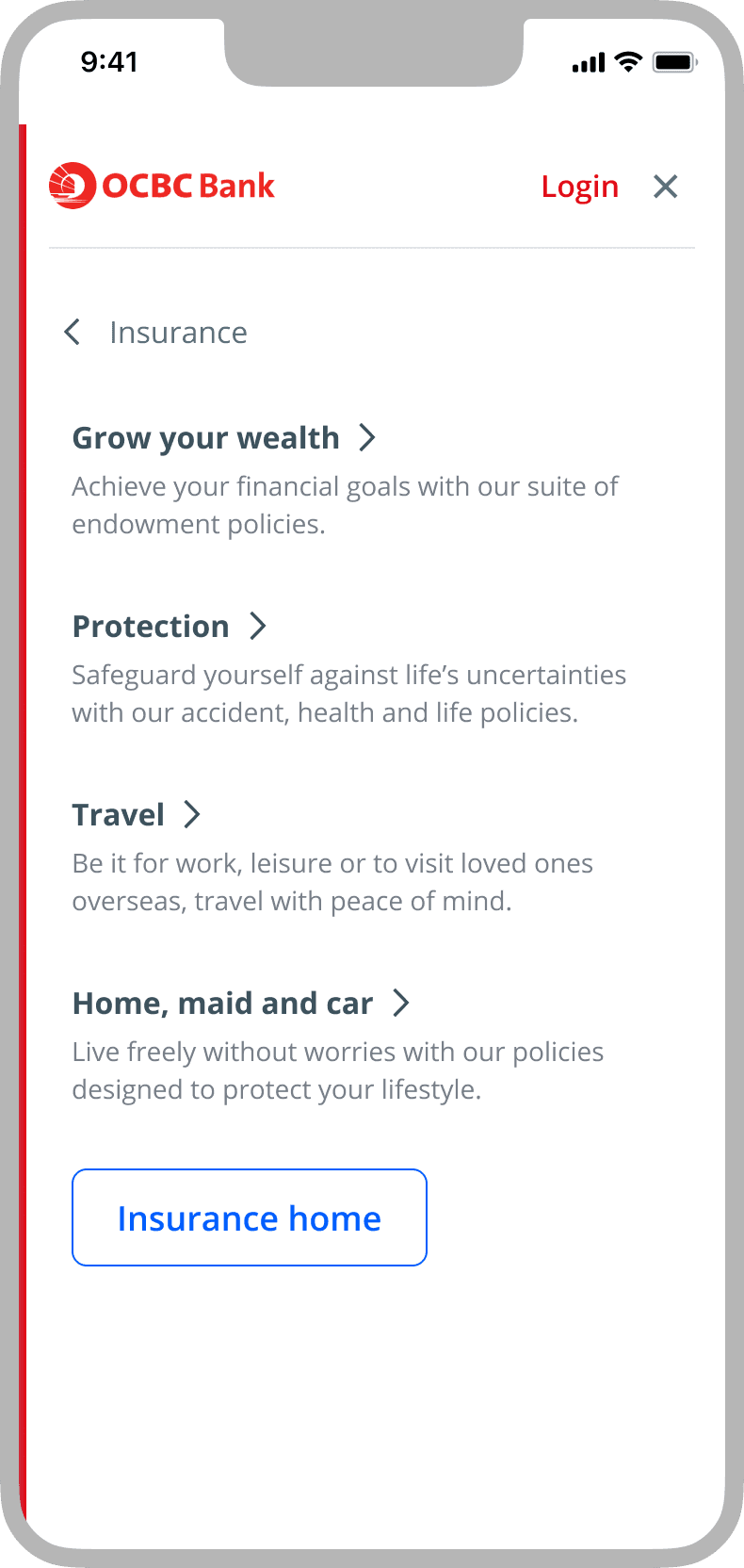

OCBC Website Insurance Section Enhancement

Enhancement of the insurance section on the OCBC website to better help customers discover and compare OCBC insurance products.

Awareness

Discovery

Consideration

01/04

Improved Navigation

We improved the quick navigation menu by displaying categories instead of individual policies. This change was made because customers often could not tell what a policy was about just from its name.

Additionally, we simplified the names of the categories to make them easier for customers to understand, as many found the previous names confusing.

Previous

Redesign

02/04

Policy Filtering

The new filter feature helps customers discover relevant policies faster, without having to search through a long list of options.

03/04

Needs-Based Discovery

The new discovery feature allows customers to identify their needs as a starting point in finding a suitable policy to explore.

04/04

Comparison Table

The new comparison feature allows customers to conveniently compare policies in a straightforward manner, eliminating the need to switch between multiple pages.

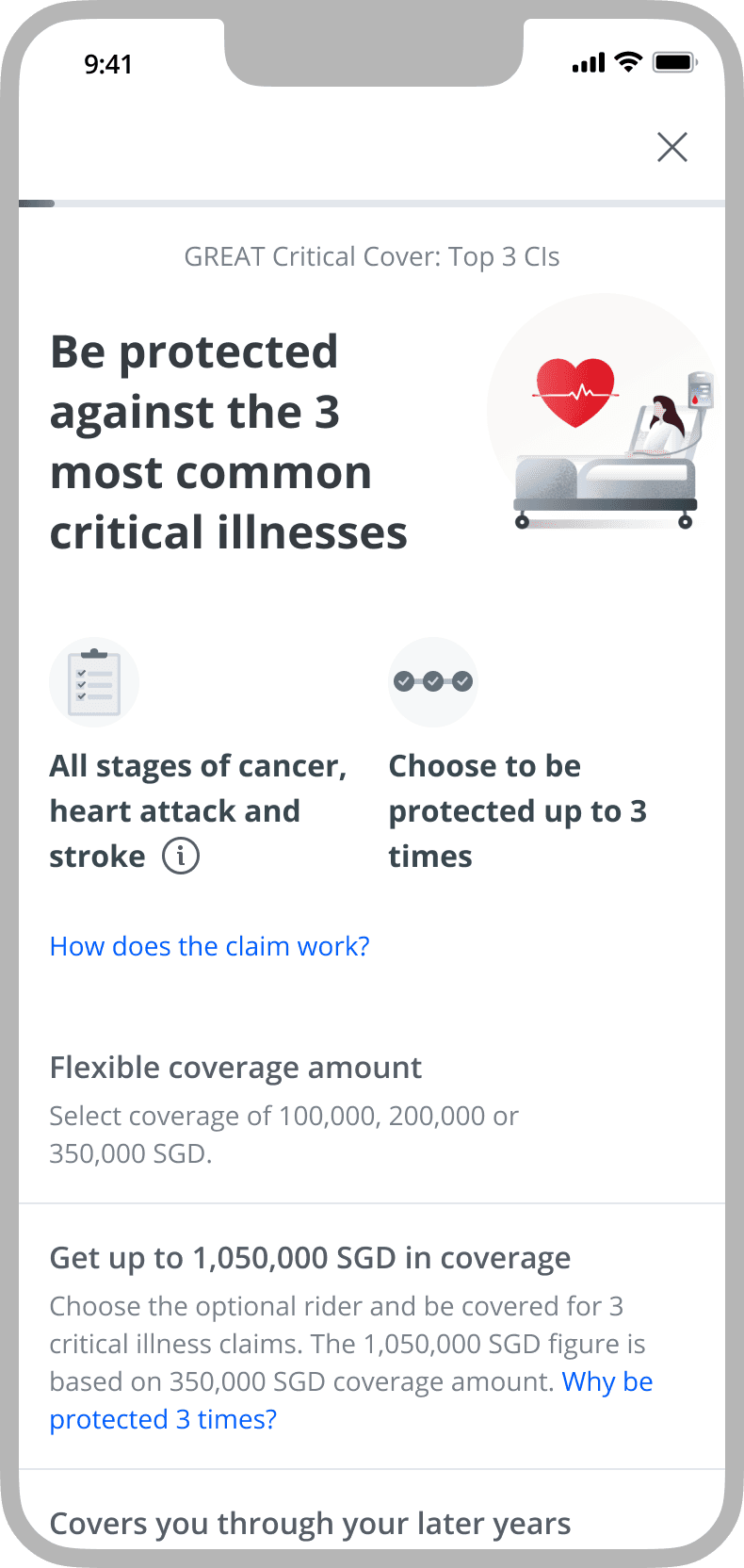

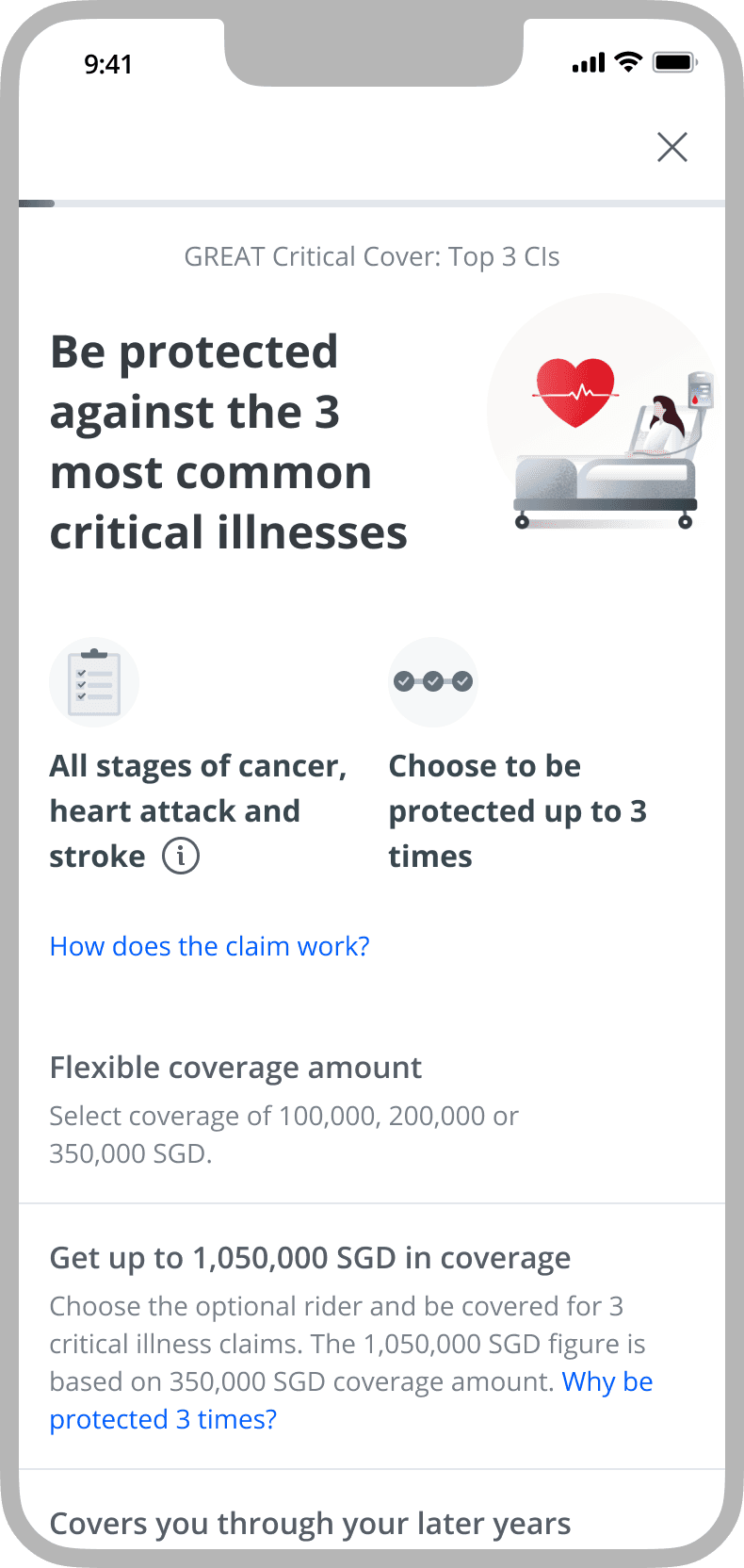

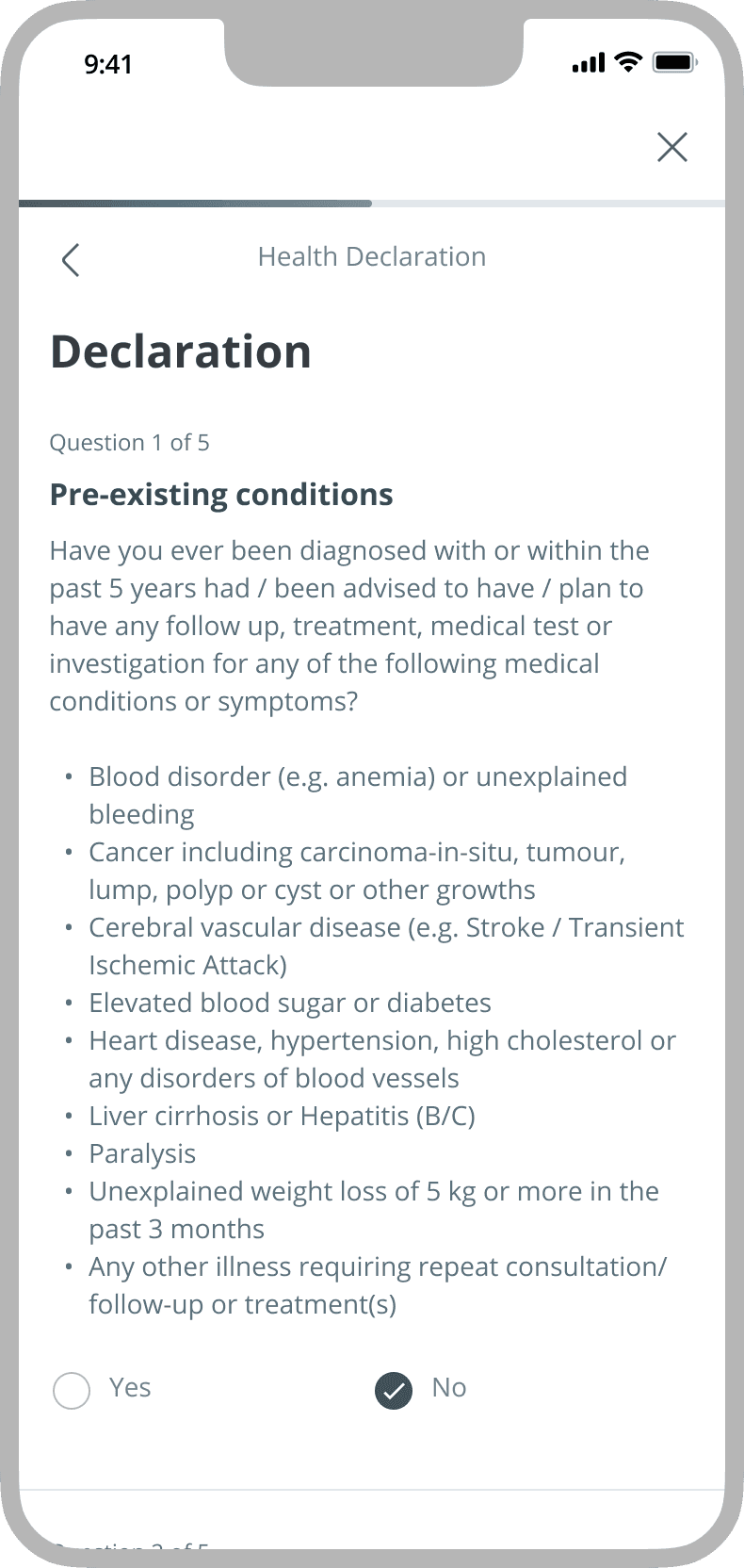

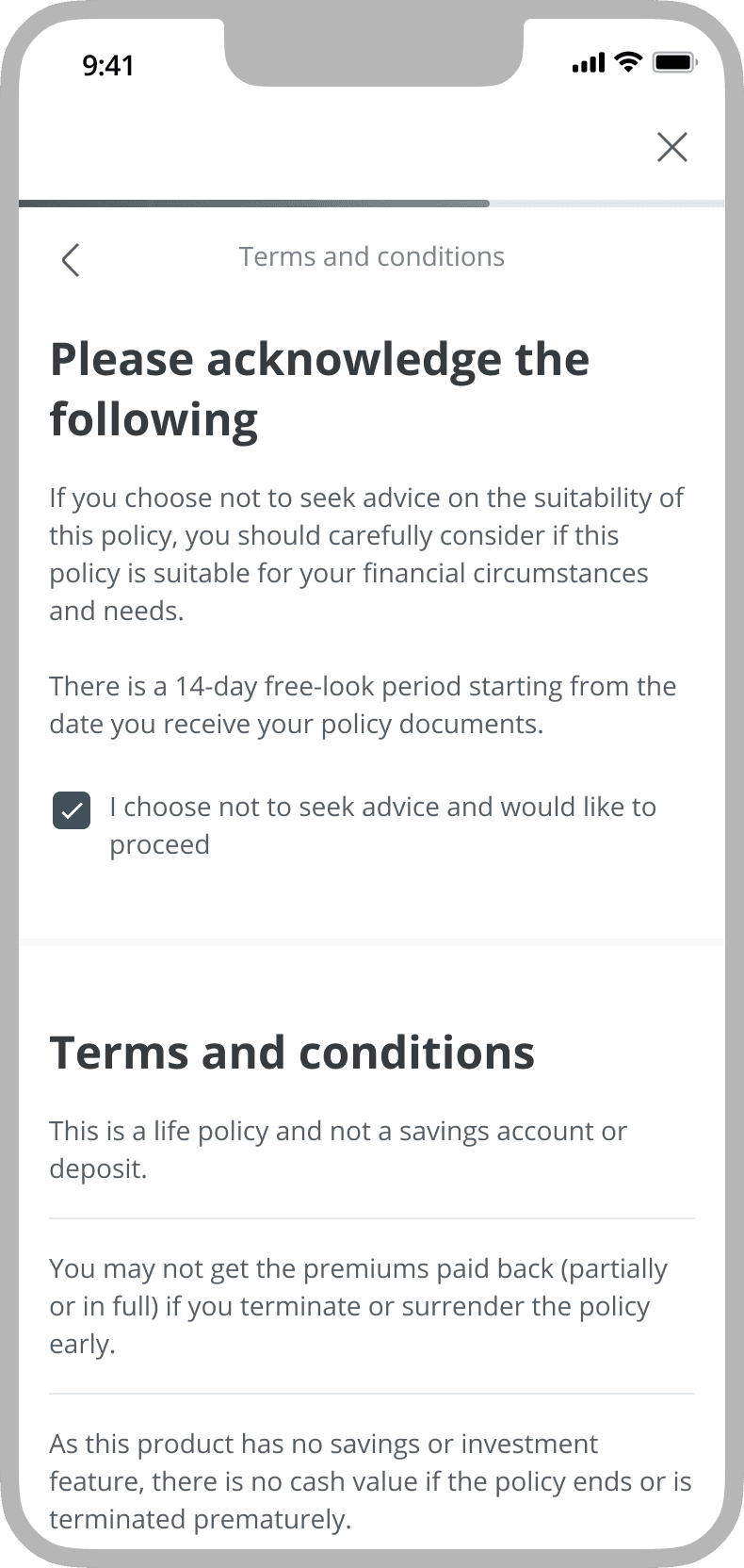

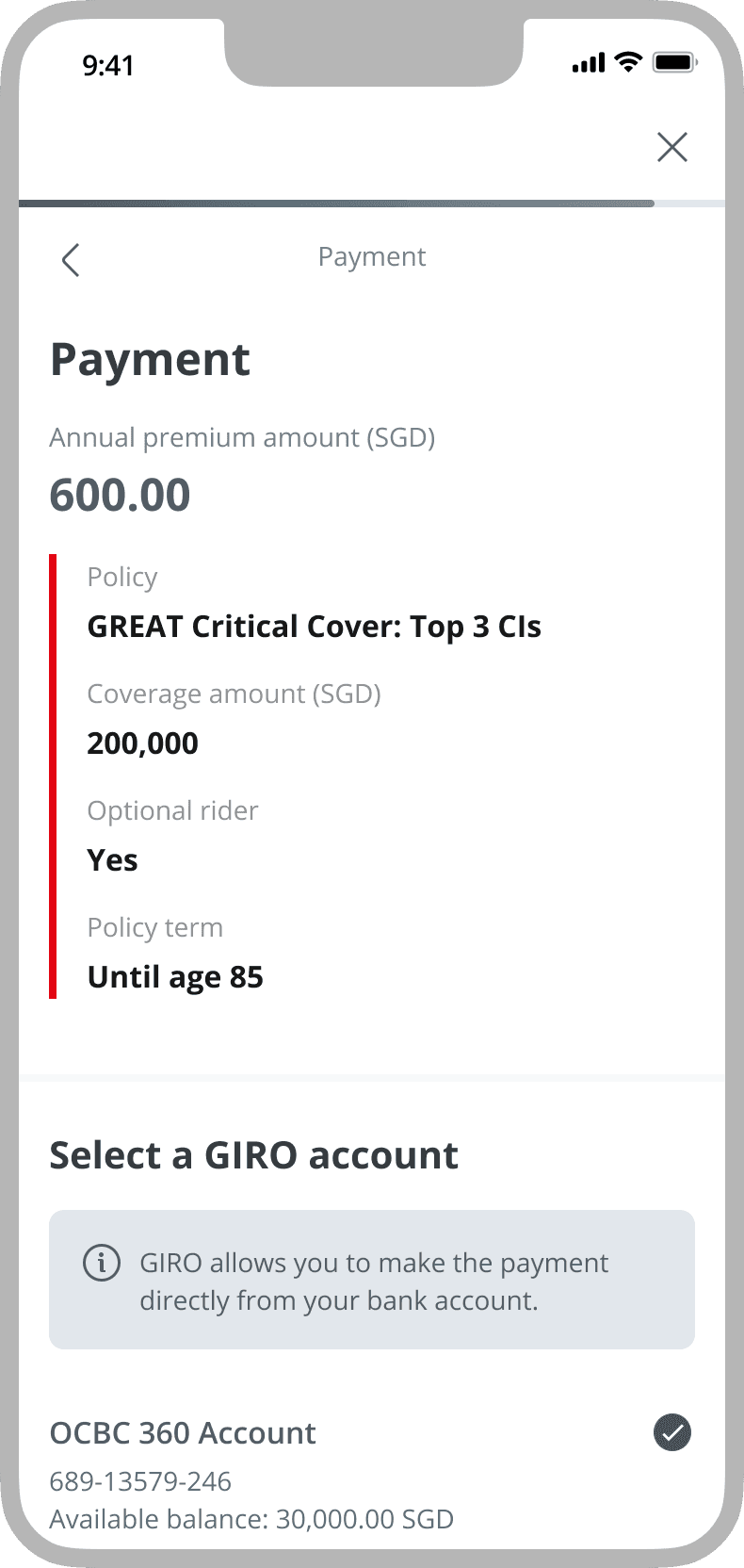

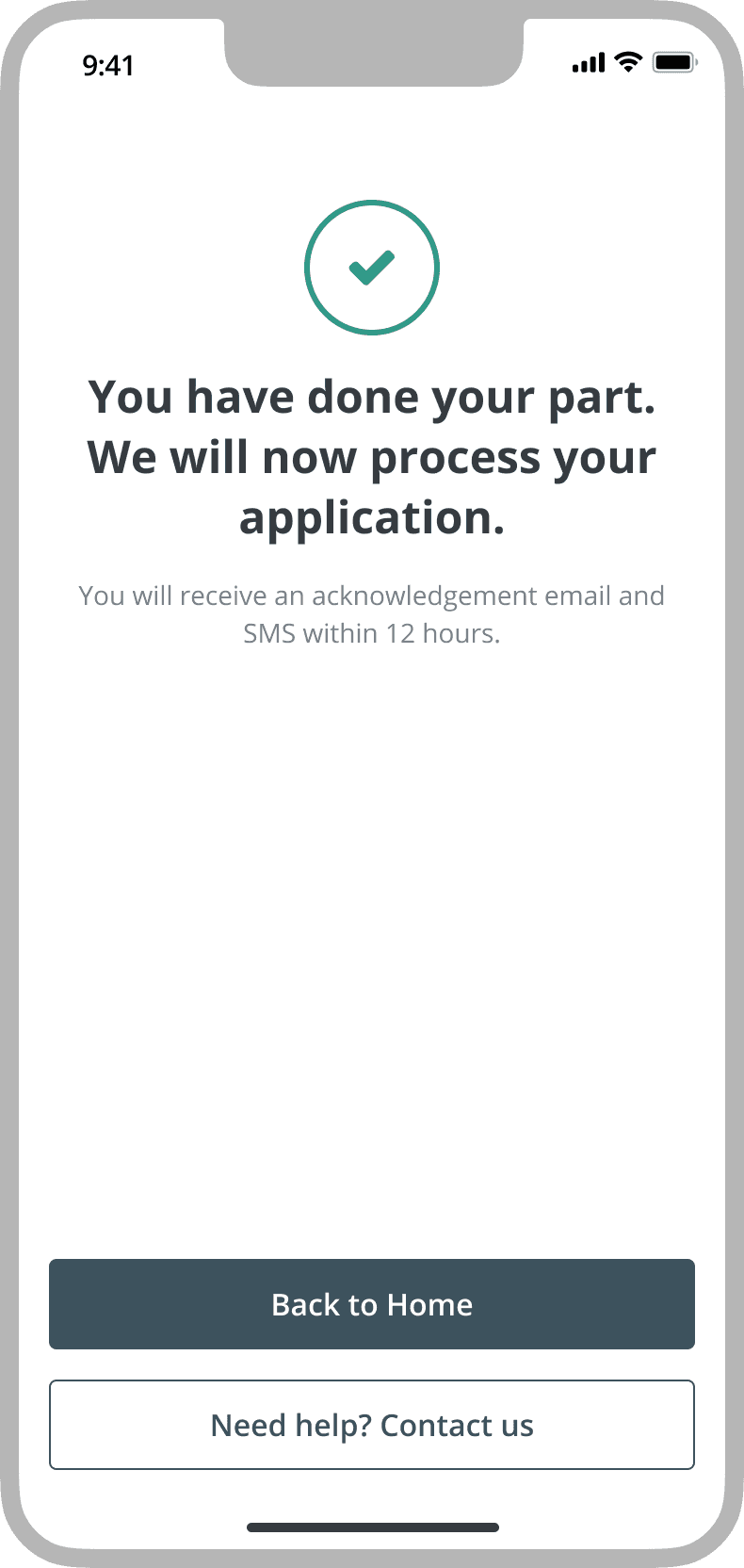

Overview

Policy Purchase Journey

The Policy Purchase Journey refers to the journey of purchasing protection, endowment, and/or travel insurance policies on the OCBC Digital app.

To illustrate the journey, I have selected a relatively complex protection insurance policy called Great Critical Cover.

Purchase

Consideration

01/04

Policy Overview

Customers get an overview of the policy's key benefits with further details on-demand.

02/04

Policy Selection

Customers can configure the policy to suit their needs and get instant and exact pricing.

03/04

Declarations

Necessary steps for customers prior to purchase.

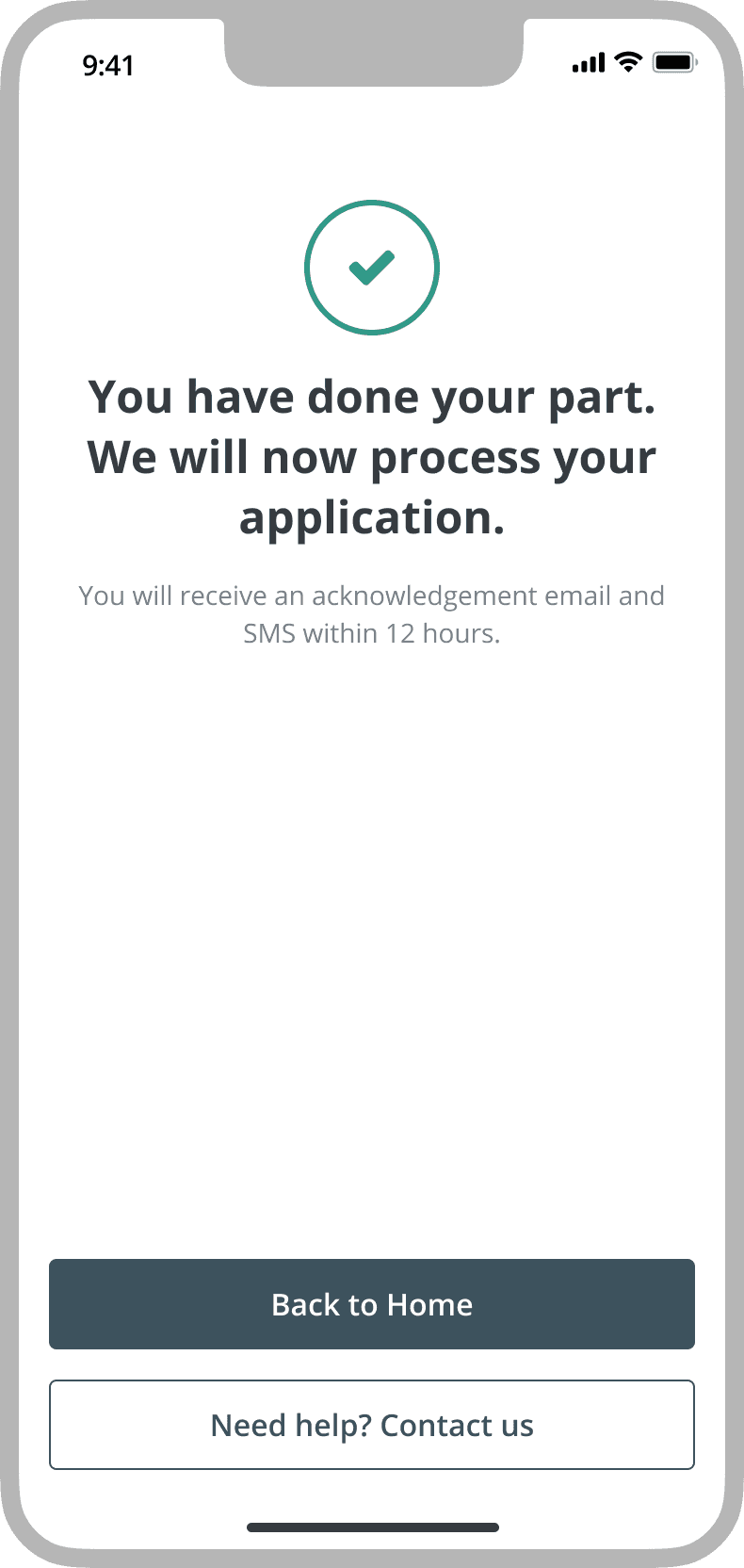

04/04

Payment & Confirmation

Customers review their selection and pay their first premium.

Impact & Awards

Impact & Awards

Impact

Impact

Digital insurance sales have contributed over $500m in revenue.

Year-on-year digital sales growth exceeded 20% in both 2022 and 2023.

OCBC's insurance customer journey achieved a CSAT score of 4.4/5 in 2023, the highest among the tracked journeys bank-wide.

Digital insurance sales have contributed over $500m in revenue.

Year-on-year digital sales growth exceeded 20% in both 2022 and 2023.

OCBC's insurance customer journey achieved a CSAT score of 4.4/5 in 2023, the highest among the tracked journeys bank-wide.

Awards

Awards

OCBC's digital insurance policy purchasing journey was awarded the SG Mark Gold award in 2022.

GREAT Term Guard was awarded Best Life Insurance Product by The Asian Banker in 2023.

OCBC's digital insurance policy purchasing journey was awarded the SG Mark Gold award in 2022.

GREAT Term Guard was awarded Best Life Insurance Product by The Asian Banker in 2023.

Final Thoughts

Final Thoughts

There is still a long way to go before exploring and purchasing insurance online becomes commonplace. Given the vast number of similar policies out there and concepts shrouded in jargon, it is no wonder customers are hesitant and intimidated to buy insurance online.

While the OCBC Digital App empowers customers to make their own decisions, at their own pace, it is only one piece of the puzzle. I believe the next step to enhancing a customer's journey in purchasing insurance online is equally crucial: the end-of-policy phase.

It is paramount that insurers make the claims process more transparent and accessible. Many customers rule out insurance providers precisely because of convoluted claim processes and a lack of trust that they will be successful in their claim.

If the above can be addressed and customers can learn to trust insurers, I believe there would be greater willingness to explore purchasing insurance online, reducing their reliance on agents.

There is still a long way to go before exploring and purchasing insurance online becomes commonplace. Given the vast number of similar policies out there and concepts shrouded in jargon, it is no wonder customers are hesitant and intimidated to buy insurance online.

While the OCBC Digital App empowers customers to make their own decisions, at their own pace, it is only one piece of the puzzle. I believe the next step to enhancing a customer's journey in purchasing insurance online is equally crucial: the end-of-policy phase.

It is paramount that insurers make the claims process more transparent and accessible. Many customers rule out insurance providers precisely because of convoluted claim processes and a lack of trust that they will be successful in their claim.

If the above can be addressed and customers can learn to trust insurers, I believe there would be greater willingness to explore purchasing insurance online, reducing their reliance on agents.